Best Crypto Exchange 2021 – Compare Bitcoin Exchanges

If you’re looking to trade popular cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin you will need to pick one of the best crypto exchanges out there. But with so many top Bitcoin exchanges out there, how do you choose the best crypto exchange in 2021?

In this guide, we’ll reveal the best Bitcoin exchange in 2021 and show you how to buy and sell cryptos with 0% commission today!

Best Exchange to Buy Bitcoin List 2021

Let’s take a look at a top-ten list of the best crypto exchanges in 2021 below. For an in-depth review of each cryptocurrency exchange keep reading!

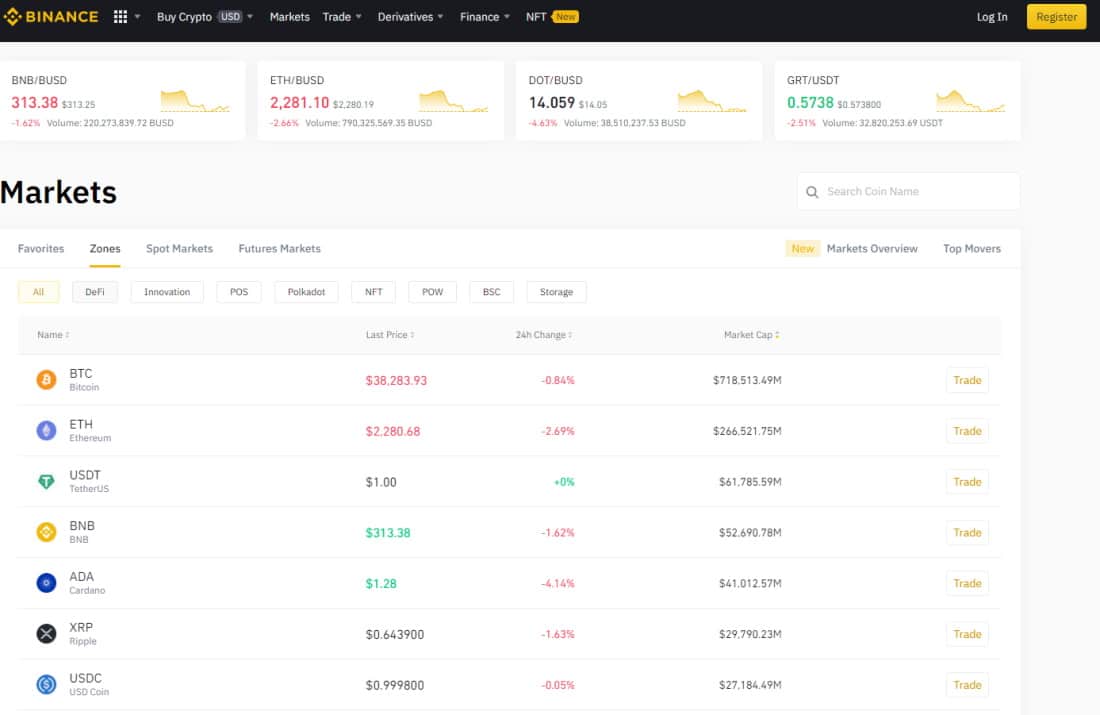

- Binance – Top Decentralized Crypto Exchange with Highest Daily Trading Volumes

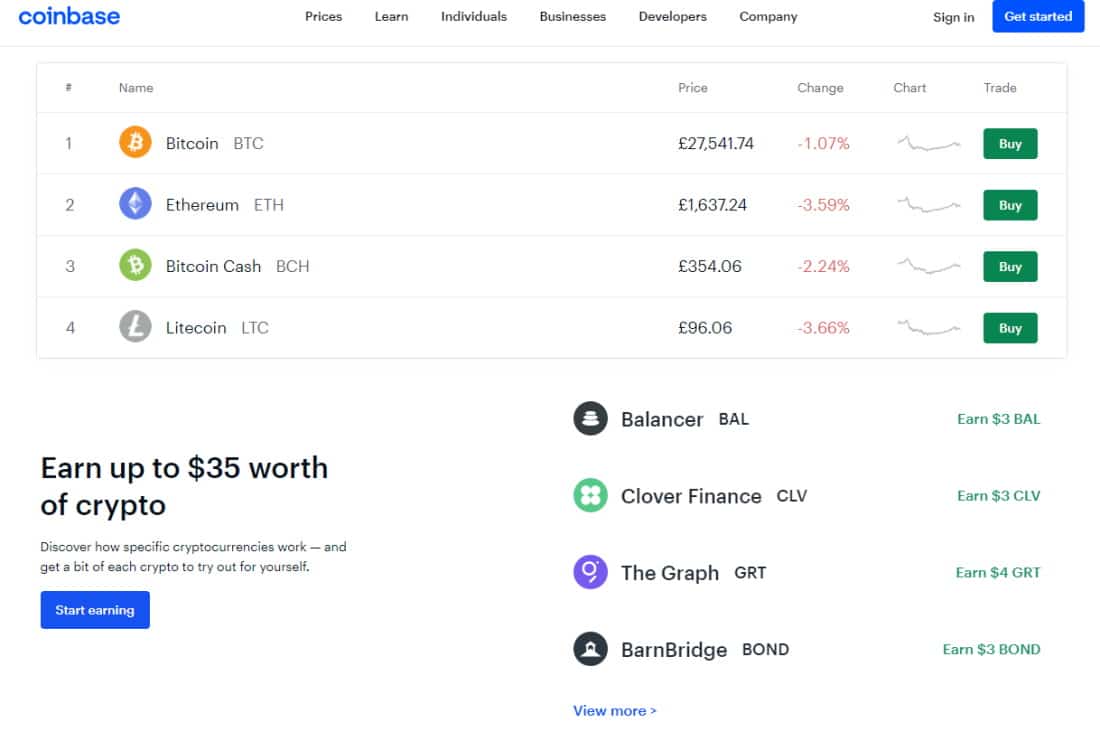

- Coinbase – Best Bitcoin Exchange for Beginners

- OKEx – Best Exchange to Buy Bitcoin with a Secure Crypto Wallet

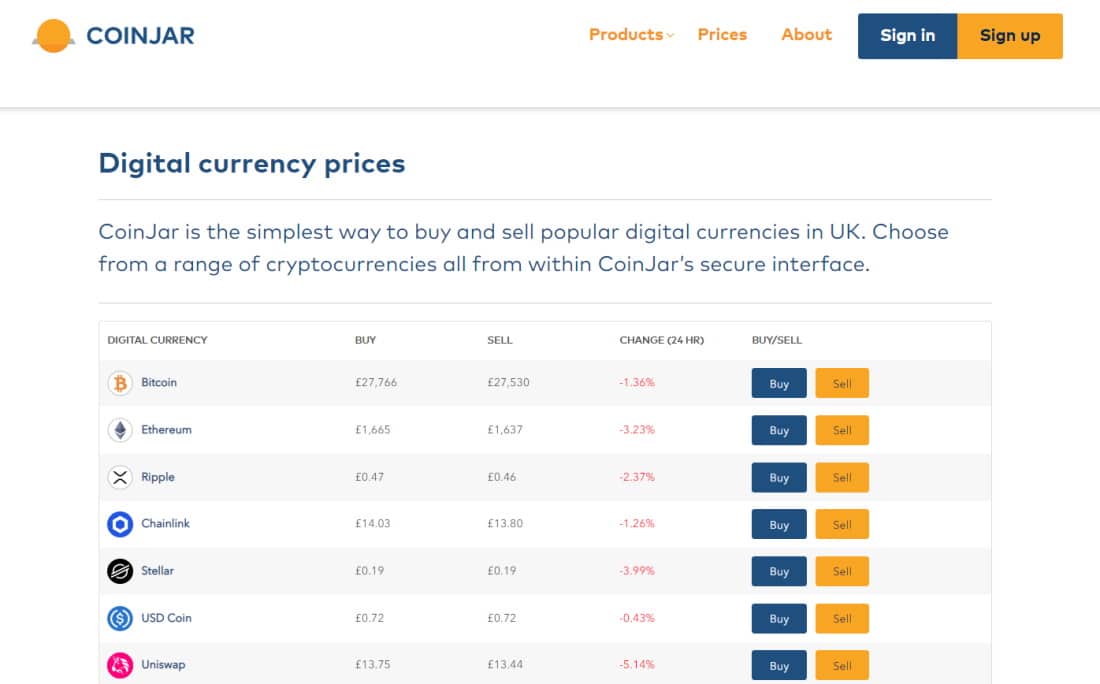

- CoinJar – Best Crypto Exchange with Low Minimum Deposit

- Gemini – Best Bitcoin Exchange with 24/7 Customer Support

- Coinmama – Best Crypto Exchange with User-Friendly Platform

- Kraken – Safest Crypto Exchange Regulated by the UK’s FCA

- Bittrex – One of the Best Crypto Exchanges for New Crypto Traders

- Capital.com – Best Crypto Exchange with Lowest Fees

Best Crypto Exchanges Reviewed

When looking for the best Bitcoin exchanges for your trading needs – there are a few key metrics to bear in mind. For instance, the best bitcoin exchanges offer a wide range of crypto assets with market-leading commissions and spreads. You also need to see what payment methods are available and whether the platform is regulated and safe.

To help you pick the best platform, we’ve reviewed the best crypto exchanges available across the board in 2021.

1. Binance – Top Decentralized Crypto Exchange with Highest Daily Trading Volumes

What are the costs when trading with Binance? This cryptocurrency exchange has some of the cheapest fees when compared to some of its main competitors. The crypto spot trading fee starts at 0.1% and the instant buy/sell fee is set at 0.5%. If you use BNB tokens you can access discounted trading fees on the Binance platform. The account minimum is $10, and you can deposit funds via wire transfer, ACH deposits, and debit cards.

In terms of regulations and security, Binance has been facing a lot of scrutiny from financial regulators recently, with the likes of the UK’s FCA banning the crypto exchange from conducting any regulated activities amidst growing money laundering concerns. While this does not prevent retail traders from accessing Bianance’s services through its main website, centralized financial authorities are warning against the high risks and volatility associated with crypto trading on an unregulated exchange.

What are the Main Trading & Non-Trading Fees?

| Direct Debit/Credit Card Purchase | 1-4% depending on country of residence |

| Bank Transfer Deposit | FREE in many countries |

| Crypto Deposit | Blockchain fee only |

| Standard Commission | Starts at 0.1% per slide |

| Futures Trading | Starts at 0.04% per slide |

| Margin Rate | Depends on coin |

- Facilitates trading volumes in excess of $13bn

- Access to 50+ cryptos

- Competitive trading commissions starting from just 0.1% per slide

- Intuitive platform with high liquidity when trading

- Supports 62 payment methods for peer-to-peer trading

Cons

- Binance.US not available in 7 US states.

Cryptoassets are highly volatile unregulated investment products.

2. Coinbase – Best Cryptocurrency Exchange for Beginners

Trading commissions come in all shapes and sizes depending on the crypto exchange. With that in mind, our Coinbase review found that it charges a standard commission of 1.49% per slide. Simply put, this means that you will have to pay a commission every time you open a position and again when you close the trade. Coinbase also charges a 2% spread for crypto-to-crypto exchanges. As you may have noticed the Coinbase fee structure can be rather convoluted and as such we’ve created a convenient table that reveals the key fees you need to keep in mind when trading on Coinbase.

What are the Main Trading & Non-Trading Fees?

| Fee Type | Charge |

| Debit Card Purchase | 3.99% |

| Bank Transfer Deposit | FREE |

| Debit Card Withdrawal | 2% |

| Bank Transfer Withdrawal | FREE |

| Standard Commission | 1.49% |

| Spread | 2% |

What payment methods does Coinbase support? When it comes to depositing and withdrawing funds into and from your account, Coinbase supports three options; cryptocurrency, debit cards, and bank transfers.

Is Coinbase safe? Most Bitcoin exchanges are unregulated by financial authorities which means that your capital is at risk. Nevertheless, Coinbase is authorized to offer services in the UK as it holds an e-money license from the Financial Conduct Authority. It’s important to note here that cryptocurrencies are not protected by the Financial Services Compensation Scheme (FSCS). Additionally, Coinbase is listed on the NASDAQ exchange which means that it discloses its financial records to the public. Furthermore, Coinbase is also registered as a Money Services Business with FinCEN.

- Home to over 35 million crypto enthusiasts

- 50+ supported digital currencies

- Conveniently deposit funds with a debit card, crypto, or bank transfer

- Intuitive interface ideal for beginners

- Registered as a Money Services Business with FinCEN.

Cons

- 3.99% fee to buy crypto with a debit card

Cryptoassets are highly volatile unregulated investment products.

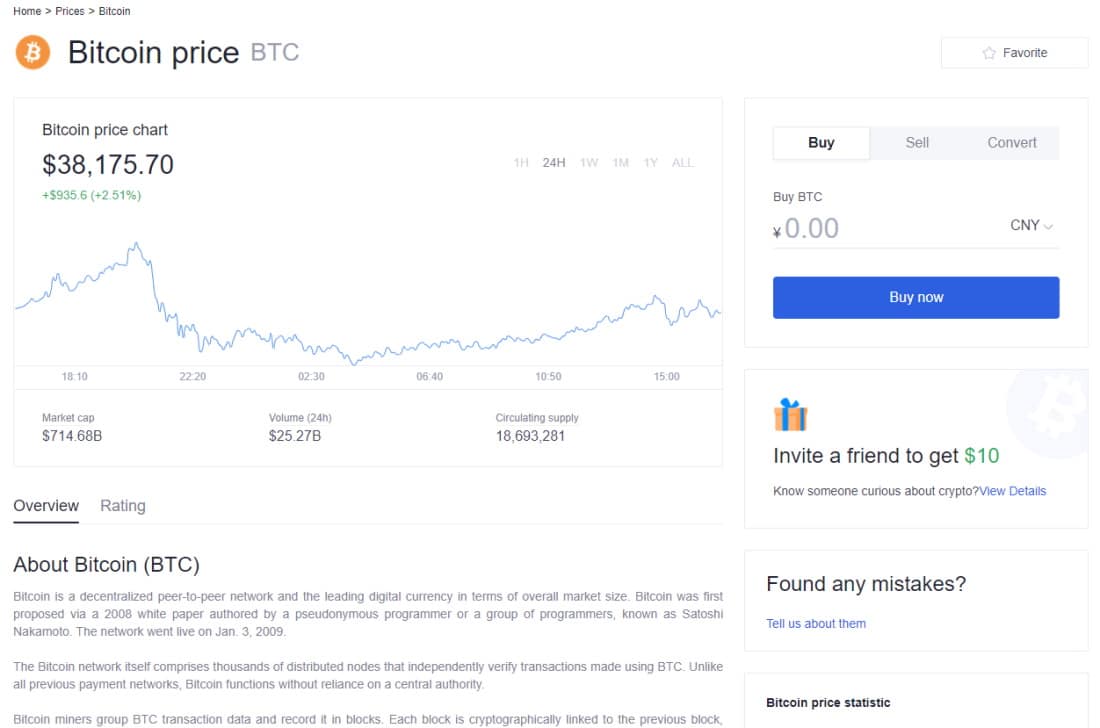

3. OKEx – Best Exchange to Buy Bitcoin with a Secure Crypto Wallet

When it comes to the spot trading fees, these are tier-based and are determined by your total OKB holding. OKEx’s maker-taker fee model starts at a mere 0.1% – 0.15% for retail traders holding less than 500 OKB tokens. The lowest spot trading fees are charged at tier 5 where OKEx charges 0.06% – 0.09% for clients holding over 2,000 OKB tokens.

If you are interested in buying cryptocurrencies via a more convenient method, which would suit beginners, OKEx also accepts fiat currency deposits. However, to do this you will need to complete the KYC process. Nevertheless, this can be done in a matter of minutes and you can then go on to buy cryptos with a debit card, credit card, or deposit funds with a bank transfer.

What are the Main Trading & Non-Trading Fees?

| OKEx | |

| Minimum Deposit | £7.25 |

| Maximum Leverage | 100:1 |

| Payment Methods | Bank transfer, credit/debit card, Apple Pay, gift cards, Google Pay, Skrill, Crypto Transfer, Alipay, WeChat Pay |

| Trading Fees | None |

| Available Platforms | Web, mobile |

| Withdrawal Fees | Based on blockchain load |

| Account Opening Fees? | No |

Is OKEX safe? OKEx continues to highlight its commitment to offering the best security for its clients. This top crypto exchange doesn’t just offer top-tier security features and technology for its users, but it also uses advanced security systems for its internal crypto wallets. OKEx goes that one step further and offers guides related to online account security as well as tutorials on how to keep your digital assets safe online. Here’s a quick summary of the type of security features you can find on OKEx:

- Google Authenticator

- Mobile verification

- Mandatory 2FA

- Email verification

- Login password

- Funds password

- Anti-phishing code

Additionally, OKEx’s service provider, Aux Cayes FinTech Co. Ltd, is registered with the Seychelles Financial Services Authority (FSA).

- Low commissions from just 0.1%

- Trade cryptos via debit/credit card or bank transfer

- Low minimum deposit

- Access to 150+ cryptos

- Store your cryptos in the OKEx secure cold wallet

Cons

- Credit/debit card fees slightly above average

Cryptoassets are highly volatile unregulated investment products.

4. CoinJar – Best Crypto Exchange with Low Minimum Deposit

What are the trading fees on CoinJar? When using a Visa or Mastercard, UK-based clients are charged a 2% instant purchase fee; however, Faster Payment Service deposits are free of charge. There is also a 1% conversion fee. What about costs that aren’t related to trading? When using cryptos to make a deposit, there are no costs. Similarly, there are no withdrawal fees.

A variable fee of 1% will be charged if you want to buy one of the supported digital assets on CoinJar. If you use CoinJar to trade crypto pairs, however, the price structure is different as it uses a maker-taker fee rate structure.CoinJar accepts bank transfers and cryptocurrency deposits.

What are the Main Trading & Non-Trading Fees?

| Method | Fee |

| Faster Payments Service deposit | No fee |

| Instant Buy (Visa or Mastercard purchase) | 2% fee# |

| Receiving digital currencies | No fee |

| Receiving digital currencies from CoinJar users | No fee |

| Cash Account to Bank Account | No fee |

| Sending Bitcoin | Dynamic fee |

In terms of the fundamentals, CoinJar has obtained authorization and licensing from the Australian Transaction Reports and Analysis Centre. According to CoinJar, a minimum of 90% of all clients’ funds are held offline in geographically redundant secure locations. Multi-signature technology is also used by CoinJar to store crypto assets in secure hot wallets.

- User-friendly platform great for new traders

- Access to 30+ cryptocurrencies

- Fully-fledged mobile trading app

- Low minimum deposit of just £5

- Holds a license from the Australian Transaction Reports and Analysis Centre

Cons

- Charting and analysis tools may be too basic for advanced traders

Cryptoassets are highly volatile unregulated investment products.

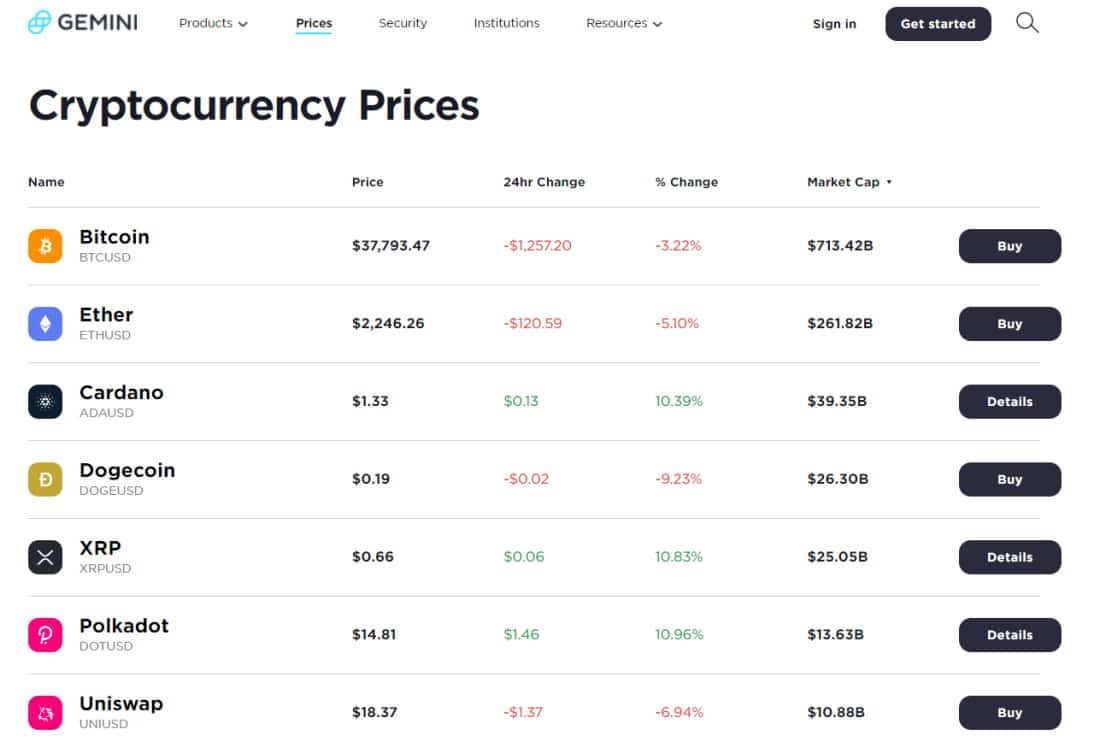

5. Gemini – Best Bitcoin Exchange with 24/7 Customer Support

Gemini is a cryptocurrency exchange established in the United States that gives users access to Bitcoin, Ethereum, and over 35 other popular cryptocurrencies. Gemini is broadening its global presence, with its main focus on Europe and Asia. Gemini is unique in that it offers a range of trading platforms based on experience. As such, beginners will appreciate the web and mobile trading apps, while advanced traders will find the ActiveTrader crypto platform a better match as it facilitates fast trade executions without compromising security or reliability.

Gemini offers a range of fee schedules based on the type of platform you use to trade cryptos. Most beginners will participate in the crypto markets via the web platform or the mobile trading app.

What are the Main Trading & Non-Trading Fees?

| Mobile / Web Order Amount | Gemini Transaction Fee |

| $0 – $10 | $0.99 |

| $10 – $25 | $1.49 |

| $25 – $50 | $1.99 |

| $50 – $200 | $2.99 |

| $200+ | 1.49% of your mobile order total |

| Deposit Fees | Cost |

| All Cryptos, ACH, Gemini dollar | Free |

| Wire Transfer | Free |

| Debit Card Transfer | 3.49% of total purchase amount |

Traders interested in depositing supported cryptocurrency assets will be required to instruct their external wallet and service provider to initiate the withdrawal to their Gemini deposit address.

Is Gemini safe?

When it comes to the security of your digital assets, Gemini gives you access to its secure cold and hot wallets. Gemini is also a New York trust company that undergoes frequent bank checks and complies with the cybersecurity standards set by the New York Department of Financial Services. Gemini is also the first cryptocurrency exchange to receive both SOC 1 Type 2 and SOC 2 Type 2 exams, in addition to earning an ISO 27001 certification.

- User-friendly platform great for new traders

- Access to 30+ cryptocurrencies

- Fully-fledged mobile trading app

- Low minimum deposit of just £5

- Holds a license from the Australian Transaction Reports and Analysis Centre

Cons

- Charting and analysis tools may be too basic for advanced traders

Cryptoassets are highly volatile unregulated investment products.

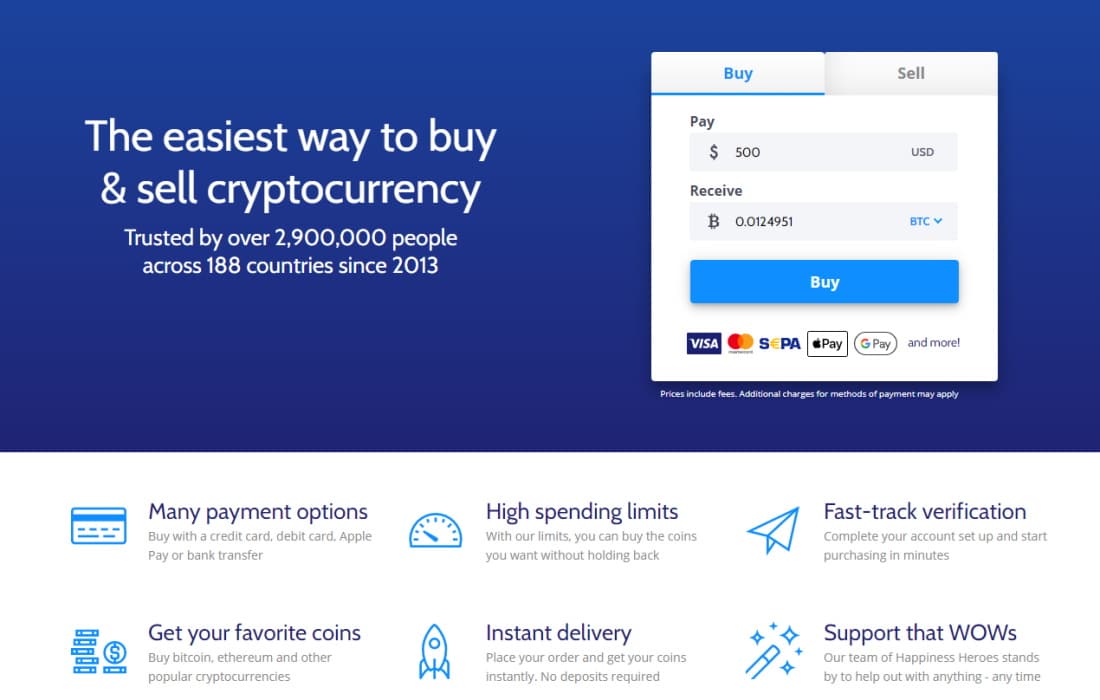

6. Coinmama – Best Crypto Exchange with User-Friendly Platform

At Coinmama you can exchange Bitcoin for various fiat currencies including USD, GBP, and EUR. This popular cryptocurrency exchange also offers a wide range of payment methods such as credit/debit cards, or directly from your bank account, Apple Pay, Google Pay, SEPA, SWIFT, Fedwire, and more.

What are the Main Trading & Non-Trading Fees?

| Direct Debit/Credit Card transaction fee | Transactions with fixed crypto rates and instant delivery – 5% express fee |

| Buy Order Commission Fee | XBX Index average + 2% + commission fee up to 3.90% |

| Sell Order Commission Fee | XBX Index average + 2% + sell fee 0.9% – 1.9% |

| Bank transfer | No added fees |

| SEPA transfer | No added fees |

Buy order fees are based on your Coinmama loyalty level and the payment method. The fees are based on the TradeBlock XBX index plus a standard deviation of 2% in addition to Coinmama’s commission fee of anything up to 3.90%. Buy orders made via bank transfers are not charged any additional fees while transactions made with a fixed crypto rate and instant delivery incur an express fee of 5%. In terms of sell order fees, these are determined by the TradeBlock XBX Index market rate plus 2% and a selling fee ranging from 0.9% and 1.9%.

Cmama Ltd, based in Ireland and a subsidiary of New Bit Ventures Ltd, operates and manages the Coinmama platform. Coinmama is a Money Service Business that is regulated and registered with FinCEN.

- User-friendly platform

- Access to 9 different cryptos

- Wide variety of payment options

- Faster Payments service available with 0% processing fees

- Coins are delivered quickly

Cons

- Does not provide a mobile trading app

Cryptoassets are highly volatile unregulated investment products.

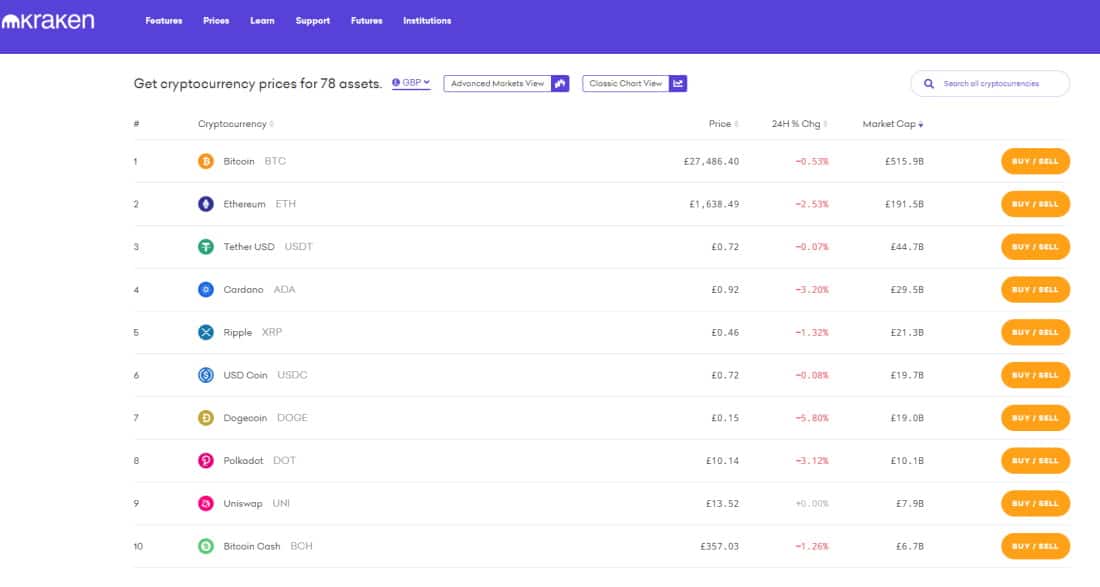

7. Kraken – Safest Crypto Exchange Regulated by the UK’s FCA and FinCEN

If you’re interested in buying or selling cryptos via the Kraken platform or the mobile app, the following trading fees are charged:

| Kraken Fee | Payment Card Processing Fee | Online Banking Processing Fee |

| 0.9% for any stablecoins

1.5% for other cryptos |

3.75% + €0.25 | 0.5% |

What are the maker-taker fees at Kraken?

| 0-Day Volume (USD) | Maker | Taker |

| $0 – $50,000 | 0.20% | 0.20% |

| $50,001 – $100,000 | 0.16% | 0.16% |

| $100,001 – $250,000 | 0.12% | 0.12% |

| $250,001 – $500,000 | 0.08% | 0.08% |

| $500,001 – $1,000,000 | 0.04% | 0.04% |

| $1,000,000+ | 0.00% | 0.00% |

In terms of payment methods, there are two different ways to deposit funds on Kraken. The first option is via a bank wire transfer and the second option is by depositing cryptocurrency. The best part is that when you deposit with cryptocurrencies there are no deposit fees. The withdrawal fees vary depending on whether you withdraw cryptos or fiat currencies.

- Heavily regulated cryptocurrency exchange

- Access to wide range of digital assets

- Various payment options

- Access to crypto derivatives trading such as crypto futures

- User-friendly platform

Cons

- Credit/debit card deposits are only available in EUR.

Cryptoassets are highly volatile unregulated investment products.

10. Bittrex – One of the Best Crypto Exchanges for New Crypto Traders

Bittrex offers some of the cheapest trading fees out there with commissions starting at 0.50% per trade when you open and close positions, regardless of the digital asset or crypto pair you are trading. The trading fees are based on your 30-day trading volume in USD, which means that the higher your trading volume the lower your trading fees are.

What are the Main Trading & Non-Trading Fees?

| Bittrex Fee Schedule 30-Day Volume (USD) | Maker fee | Taker fee |

| <25k | 0.35% | 0.35% |

| 25k-50k | 0.25% | 0.30% |

| 50k-100k | 0.15% | 0.25% |

| 100k-1m | 0.10% | 0.20% |

| 1m-5m | 0.06% | 0.16% |

| Transaction Fees | Blockchain | Fiat |

| Deposits | None | No charge for USD deposits and withdrawals |

Is Bittrex safe? Bittrex has a Class F Digital Assets Business Act license to conduct its services under the regulations of the Bermuda Monetary Authority.

- Low trading fees with 0.50% commission per trade

- Fully-fledged integrated crypto wallet

- Platform is easy to use

- $50 minimum deposit

- Fully regulated by the Bermuda Monetary Authority

Cons

- Does not accept credit cards, Mastercard debit cards, or e-wallets such as Skrill, PayPal.

Cryptoassets are highly volatile unregulated investment products.

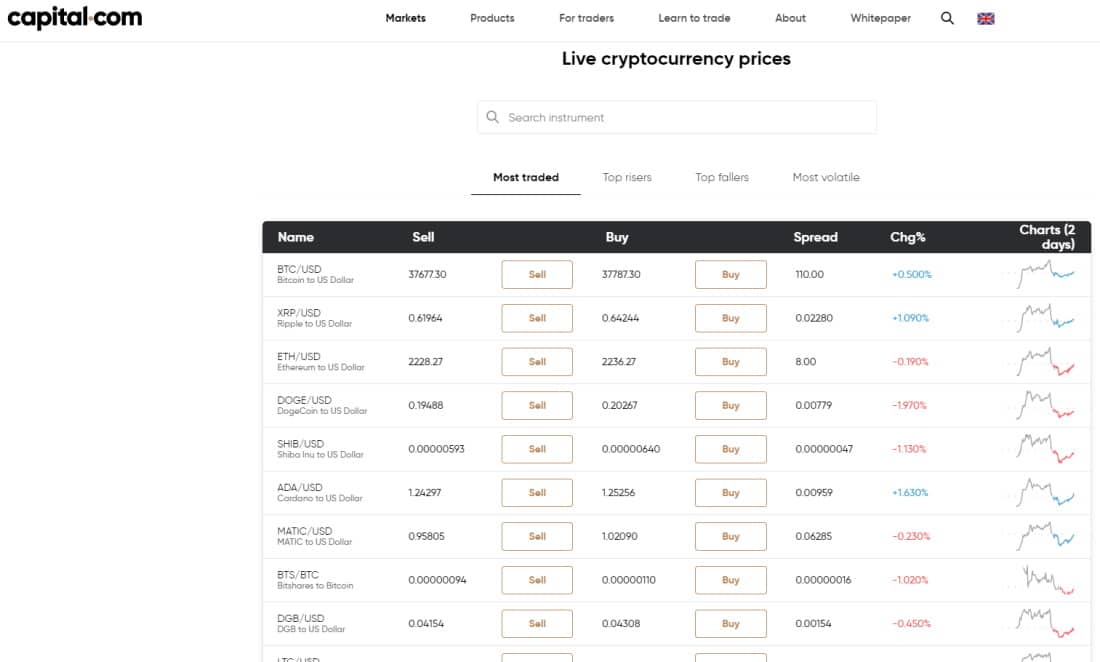

9. Capital.com – Best Crypto Exchange with Lowest Fees

With Capital.com you can trade popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, Cardano, and much more without having to worry about storing them in crypto wallets or gaining ownership of the underlying assets. This is because Capital.com offers cryptocurrency CFDs (contracts for difference) which allow you to speculate on the price movements of the underlying cryptos with leverage of up to 2:1.

In terms of crypto pairs, you can access both crypto-to-fiat and crypto-to-crypto pairs. For instance, you could trade Bitcoin to US Dollar (BTC/USD) CFDs with a spread of 110.00 pips, 50% margin, and 0% commission on the trade.

What are the Main Trading & Non-Trading Fees?

| Non-trading fees | Charge |

| Overnight Fee | Overnight fee charge on indices, commodities, and forex is based on the total value of the position. For Cryptos, Shares, and thematic investments Capital.com charges an overnight fee based only on the leverage provided. |

| Deposit Fee | 0% |

| Withdrawal Fee | 0% |

| Inactivity Fee | None |

| Account Fee | None |

| Trading Fee | Charge |

| CFD trading | 0% Commission; Overnight on leverage is not included in the spread |

| Forex trading | 0% Commission; Overnight on leverage is not included in the spread |

| Crypto CFD leverage | Up to 2:1 |

- Access to heaps of crypto CFDs with 0% commission

- Regulated by the FCA, CySEC, and NBRB

- Demo account ideal for beginner traders

- Huge selection of payment methods including Apple Pay

- Low non-trading fees

Cons

- Cannot set price alerts on the web trading platform

76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Bitcoin Exchanges Comparison

| Platform | Trading Commission | Deposit Fee | Withdrawal Fee | Payment Methods | Supported Cryptos |

| Binance | 0.10% | Up to 4% on Debit/Credit Cards | Depends on Payment Method | Debit/Credit Cards, Crypto, Bank Transfer | Binance offers crypto-to-crypto trading in over 500 cryptocurrencies such as BNB/BUSD, as well as hundreds of cryptocurrencies including Bitcoin, Ethereum, USDT to name a few. |

| Coinbase | 1.49% | 3.99% on Debit/Credit Cards | 2% on Debit/Credit Cards | Debit/Credit Cards, Crypto, Bank Transfer | Supports 5,340 digital assets such as Bitcoin, Ethereum, Binance Coin, XRP. |

| OKEx | 0.10% per slide | 0% | 0% | Bank transfer, credit/debit card, Apple Pay, gift cards, Google Pay, Skrill, Crypto Transfer, Alipay, WeChat Pay | Supports 240 cryptos that can be traded against BTC, Ethereum, Tether, Litecoin and more. |

| CoinJar | 1% | 0% | 0% | Cryptos, UK bank transfers | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Lumens (XLM), Algorand (ALGO),EOS (EOS) & 20+ ERC-20 tokens |

| Gemini | 1.49% + 0.5% | 3.49% on Debit/Credit Cards | Depends on Payment Method | Debit/Credit Cards, Crypto, Bank Transfer | 30+ cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Zcash (ZEC), Chainlink (LINK), Orchid (OXT) |

| Coinmama | 3.90% + 2% Mark-Up | 5% on Credit Cards | Automatic Wallet Transfer | Debit/Credit Cards, Bank Transfer | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Cardano (ADA), Litecoin (LTC), Tezos (XTZ), Ripple (XRP), Dogecoin (DOGE) |

| Kraken | From 0.20% | FREE Bank Transfers | 0.09 EUR on SEPA | Debit/Credit Cards, Crypto, Bank Transfer | Wide range of cryptos such as Aave, Algorand, Bitcoin, Ethereum, Dogecoin and more. |

| Bittrex | Starts at 0.50% per trade | 3% deposit fee for VISA and Mastercard deposits | Varies depending on whether you withdraw fiat or crypto i.e $0 withdrawal fee for USD | Bank card (VISA), wire transfer, SEPA transfer, or cryptocurrencies. | Buy, sell and trade over 500 markets including Bitcoin, Cardano, Tether, Ethereum and Dogecoin. |

| Capital.com | 0% | FREE | FREE | Debit/Credit Cards, e-wallets, Bank Transfer | Hundreds of popular crypto CFDs such as BTC/USD and ETH/BTC |

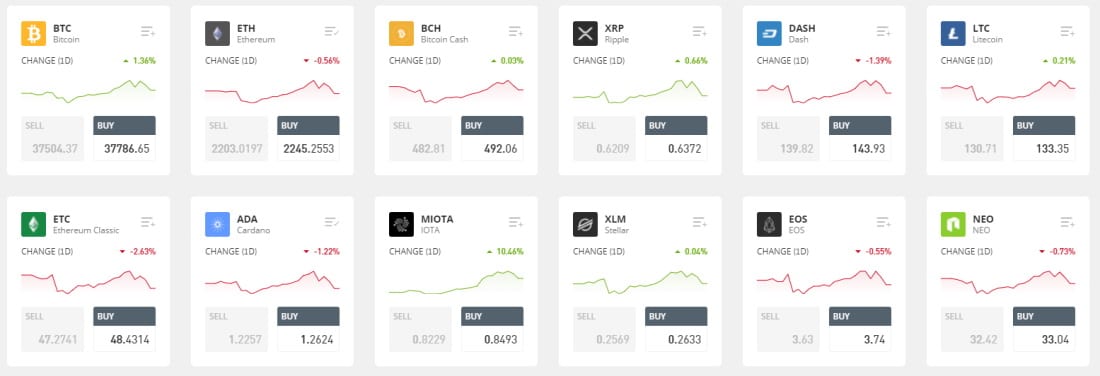

What is a Crypto Exchange?

In simple terms, a crypto exchange is a platform that allows users to buy and sell cryptocurrencies. As well as trading services, some top cryptocurrency exchanges offer price discovery via trading activity and internal crypto wallets for the safe storage of your digital assets. Before crypto exchanges were introduced traders only had access to cryptocurrencies through mining. Currently, there are heaps of Bitcoin exchanges providing a variety of cryptos and varying trading fees and payment methods.

We recommend that you assess your financial objectives and risk tolerance when choosing which exchange to use.

With that said, there are two main types of cryptocurrency exchanges that you need to be aware of:

- Decentralized cryptocurrency exchanges – cryptos and blockchain technology were set up with the ideology that currency does not need a centralized authority to manage its usage. As such, decentralized cryptocurrency exchanges (DEXs) are not overlooked by third parties, are open source, and are based on peer-to-peer trading.

- Centralized crypto exchanges are monitored by a third-party exchange operator. The role of the exchange operator is to maintain streamlined signup and trading processes at all times. Centralized crypto exchanges make it easy to use your bank account or debit card to buy cryptocurrency online. Nevertheless, this convenience often comes with transaction fees. The majority of centralized cryptocurrency exchanges allow you to trade digital currencies with either a fiat currency or other cryptos.

How do the best crypto exchanges work?

Bitcoin exchanges work by matching sellers with buyers. As is the case with conventional bank accounts, buying and selling digital assets on most crypto exchanges are permitted after successfully signing up. After you have completed the KYC process and your account has been verified you can transfer fiat or cryptos onto the platform, which can then be used to buy your preferred cryptocurrencies.