Euro dollar is now recovering from lows but remains far from a real change, as the Greek referendum is here to stay. Papandreou will be asked for explanations from his European counterparts today in Cannes. Euro-zone data has been weak. The focus will temporarily shift to the US, with a significant hint towards the Non-Farm Payrolls and Ben Bernanke’s press conference.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

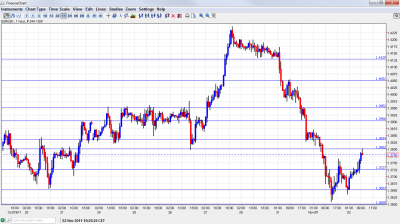

EUR/USD Technicals

- Further levels in both directions: Below 1.3725, 1.3650, 1.36, 1.3550, 1.35, 1.3450, 1.3360.

- Above: 1.38, 1.3838, 1.39, 1.3950, 1.4050, 1.4130, 1.42, 1.4250, 1.4282.

- After 1.3650 was breached, 1.36 is the next cushion.

- Strong resistance is only at 1.3838.

Euro/Dollar trying to recover – click on the graph to enlarge.

EUR/USD Fundamentals

- 8:55 German Unemployment Change. Exp. -10K. Actual +10K. Trouble at the core.

- 9:00 Euro-zone Final Manufacturing PMI. Exp. 47.3. Actual 47.1 points.

- 12:15 US ADP Non-Farm Payrolls. Exp. +102K. Hint towards Non-Farm Payrolls.

- 16:30 US FOMC Statement. No new policy changes are expected now. See preview.

- 18:15 US Federal Reserve Chairman Ben Bernanke talks.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Bernanke in Limelight: Ben Bernanke will hold a press conference following the FOMC meeting, the first presser since June. While there have been hints about further monetary easing, even QE3, the chances are slim for a change now. Given the recent positive signs in the US economy, Bernanke and his colleagues might even be cautiously optimistic.

- Greek Referendum: In a move that came as a shocker (although hinted in the past) Greece’s Prime Minister Papandeou announced that the recent EU Summit deal will be brought to the Greek public. This can delay implementation in the better scenario, and receive a NO in the more realistic scenario. There were rumors that the referendum will be called off, but Papandreou made it clear that he is pushing forward with it. There are also worrying news that the government wants to replace the heads of the army.

- Mini-Summit: On the eve of the G-20 summit in Cannes, leaders of Germany, France and Greece will meet. Also Christine Lagarde of the IMF will be there.

- EU Summit Doubts Still Felt in Italian Bonds: After a very cheerful reception for the EU Summit results, the doubts begin to rise. This begins with no demand for a specific participation in the Greek haircut, continues with doubts about the willingness of China to really help, the open question of CDS triggering and Italy’s implementation of promised reforms. As the mood settles down for now, Italian bond yields dropped to “only” 6.12%, still very high levels.

- Yen intervention fading: The Japanese authorities had enough after USD/JPY fell to 75.31 and made a sharp move in the pair, sending it as much as 400 pips higher before dropping a bit. This wild action sent EUR/USD down, and started the downfall. In the meantime, USD/JPY calmed down and EUR/USD continues on its own.