Euro dollar is now trying to break resistance. The EU Summit provided decisions on all fronts, although decisions fell short. The initial reaction was a move upwards, yet with hesitation. Only many hours later, the pair is attempting on a bigger move. Important US figures are coming soon.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

Update: Gains accelerated after US GDP came within high expectations of 2.5% (annualized, first release for Q3 2011).

EUR/USD Technicals

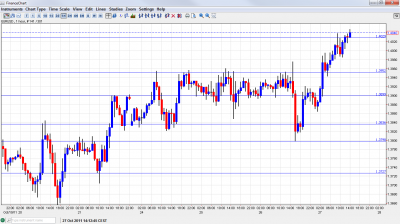

- Asian A very active session, as the EU Summit ended in the late hours in Europe – in the Asian session. The pair began moving on the news of a deal with the banks. The break above 1.4030 came only late in the European session.

- Current range: 1.4030 to 1.41.

- Further levels in both directions: Below 1.4030, 1.3950, 1.39, 1.3838, 1.38, 1.3725, 1.3650, 1.

- Above: 1.41, 1.4160, 1.4220, 1.4282. 1.4375

- If the pair settles above 1.4030, this is very significant. The breakout needs to be confirmed.

- 1.3950 is significant support now.

Euro/Dollar on the move higher – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German CPI. Exp. +0.1%. Actual 0%.

- 8:00 Euro-zone M3 Money Supply. Exp. +2.8%. Actual +3.1%.

- 12:30 US GDP, First release. Exp. +2.4%. Actual +2.5%. See analysis here.

- 12:30 US Unemployment Claims. Exp. 400K.

- 12:30 US GDP Price Index. Exp. +2.4%.

- 14:00 US Pending Home Sales. Exp. +0.2%. See how to trade this event with USD/JPY.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- EU Summit Progress: In the late hours of night (or early morning), the leaders finally cut a deal. It includes a 50% haircut on Greek debt for private bondholders (“voluntary”, reached with the banks), about 1 trillion euros of an enhanced bailout fund and around 106 billion of bank recapitalization. The last two numbers may not be sufficient, and caused the hesitation, despite the progress on all three fronts. See the analysis of the EU Summit.

- US Situation Improving?: There are high hopes for a strong GDP number in the US. This will draw a lot of attention. But also note the other important figures. The huge leap in the Philly Fed Index was great news, but with the current focus on the debt crisis, it was ignored.