Euro dollar is set for an exciting close to the month. The strong intervention to weaken the Japanese yen against the dollar was clearly felt in EUR/USD, which was already in doubt about the EU Summit deal. Also the unexpected rise in European unemployment and the stubbornly high inflation estimate is complicating matters for the common currency.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

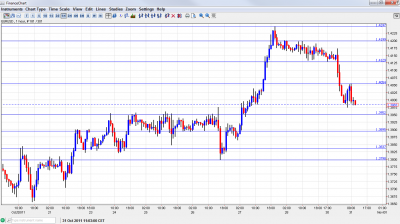

- Asian session: Lots of action after the Japanese authorities made their move. Euro/dollar fell under 1.40.

- Current range: 1.3950 to 1.4050.

- Further levels in both directions: Below 1.3950, 1.39, 1.3838, 1.38, 1.3725, 1.3650.

- Above: 1.4050, 1.4130, 1.42, 1.4250, 1.4282. 1.4325, 1.4375, 1.4450.

- 1.3950 is a strong cushion that separated the recent trading ranges.

- 1.4282 is the very strong resistance on top.

Euro/Dollar small in Japan – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Retail Sales. Exp. +1.1%. Actual +0.4%. Quite a disappointment.

- 10:00 Euro-zone CPI Flash Estimate. Exp. +2.9%.Actual 3%. This complicates matters for the rate decision.

- 10:00 Euro-zone Unemployment Rate. Exp. 10%. Actual 10.2%. This figure doesn’t move too much. The rise is worrying.

- 13:45 US Chicago PMI. Exp. 59.2 points.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Yen intervention: The Japanese authorities had enough after USD/JPY fell to 75.31 and made a sharp move in the pair, sending it as much as 400 pips higher before dropping a bit. This wild action sent EUR/USD from the tight range above 1.4130 to dip below 1.40. While the intervention isn’t coordinated, the determination of Japan seems stronger this time.

- EU Summit Doubts: After a very cheerful reception for the EU Summit results, the doubts begin to rise. This begins with no demand for a specific participation in the Greek haircut, continues with doubts about the willingness of China to really help, and the open question of CDS triggering.

- Italian bonds yields soaring: One of the stronger signs of disbelief comes from Italy. Berlusconi was forced to accept concessions, but they aren’t really huge. Until the leveraged EFSF comes into action, Italy suffers in its bond auctions and was forced to pay a dear price. The ECB, headed by Italian from Tuesday, still finds itself acting and buying bonds to lower their yields. This is a worrying sign. 10 year yields are currently at 6.14%.

- US Situation Improving: The first read of GDP for the third quarter of 2011 came out at 2.5%. This was within expectations but much better than the previous quarters. While it triggered a strong risk rally, there’s still uncertainty about how the Federal Reserve will digest this. They might raise forecasts, but some expect them to act in the meeting this Wednesday.