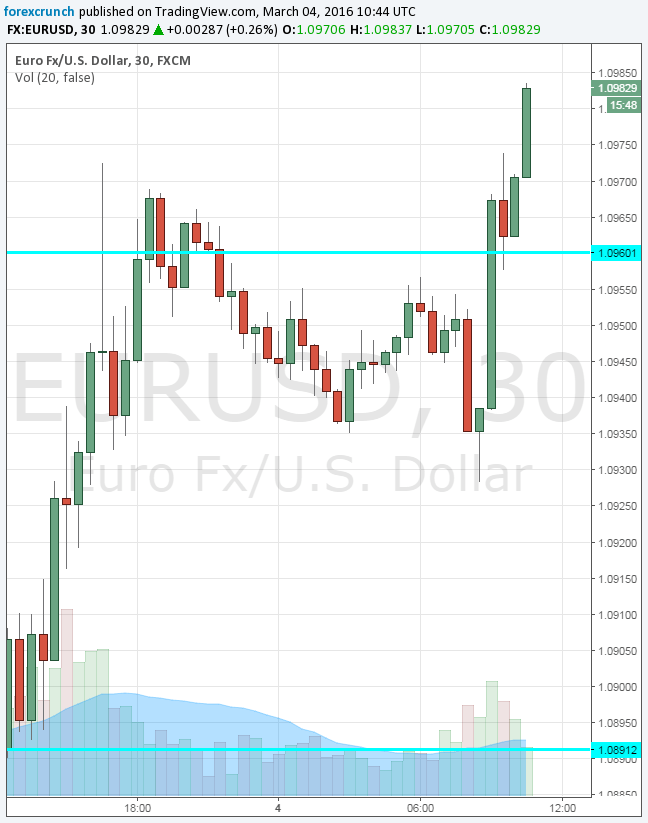

Reports coming out of the ECB talk about a consensus only on a minimal cut fo the deposit rate by 10 basis points, from -0.30% to -0.40%. Without more measures, it looks like a “too little, too late” and naturally, such news sends the euro higher:

EUR/USD is extending the gains from yesterday and edging closer to 1.10 and not staying in a tight range like in other NFP days. But is this for real? Here is why this move could turn into a sell opportunity.

Two moves, different results

If we look back into the not-so-distant history of January 2015, also then we had the ECB leak / report about smaller QE worth 50 billion per month and 500-750 billion in total. And then, he over-delivered with 60 billion a month and 1.14 trillion in total.

Leading to the December 2015 meeting, Draghi created huge expectations but certainly failed to deliver. The minimal cut of the deposit rate to -0.30% and the lack of additional bond buys (despite the pledge to re-invest proceeds and the extension to March 2017) sent the euro soaring and Draghi later expressed his disappointment.

Therefore, we can assess that the ECB night be attempting to repeat the successful move seen 14 months ago and avoid the bitter one seen 3 months ago: a move to lower expectations, under promise and then over-deliver.

What can be done?

The ECB has said that it cannot do miracles on its own and that it is the only game in town, or in their words: “the only stimulus program in the past 4 years” and Draghi did call upon governments with spare capacity to do more. But, he also said that his institution will never give up, do what it takes and this could result in more monthly buys, no end date, more instruments and a deeper cut in the interest rate.

The best transmission mechanism of the ECB has been the exchange rate. Without a weaker euro, deflation would have already taken hold and the very modest economic recovery would have been already gone.

Is it a sell opportunity on EUR/USD? We’ll know in 6 days.

In the meantime, see how to trade the NFP with EUR/USD.

EUR/USD moves

Here is the EUR/USD chart showing the move to the upside. The pair made a move decisive break above the 1.0960 line (which previously worked as resistance) and is getting close to the round number of 1.10. Further ahead we have 1.1070 and 1.12. On the downside, 1.0890 and 1.0825 are lines of support, with much stronger support at 1.0710.