Idea of the Day

This could be a tricky end of the month. On top of the usual month end flows that can create greater than normal volatility, there are political complications both in the US and Europe. The US is facing a government shut-down for the first time in 17 years unless a deal on a budget is reached today, the last day of the current financial year. In Europe, the Italian government is looking incredibly unstable after Berlusconi withdrew his support for the current coalition. Bond yields in Italy have risen some 30bp since the middle of last week. The impact of the US situation has more been felt in equities and the Aussie, rather than the dollar itself, which continues to hold up on the basis of being the world’s reserve currency. So for today at least, volatility is likely to be the name of the game, with the fate after that in the hands of US politicians.

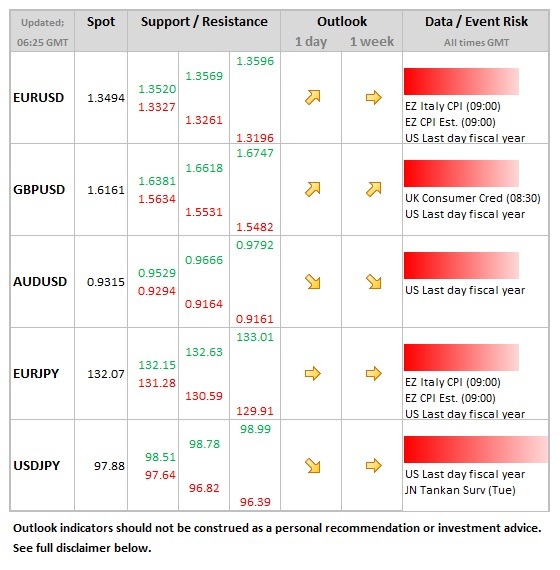

Data/Event Risks

USD: Today is the last day of the US fiscal year. With no budget or continuing resolution agreed, this would lead the US government shutting down as from tomorrow. So focus will be on political developments in the US. So far, dollar has been firmer as ‘risk-off’ sentiment dominates and US politicians don’t give any sign of looking towards a compromise.

EUR: The first estimate for Eurozone CPI is released this morning. Headline inflation is seen easing further to 1.2% (from 1.3%). Anything lower than expected could well increase expectations of further policy measures from the ECB, perhaps more longer-term loans, which would be negative for the single currency.

JPY: Abe set to announce fiscal package on Tuesday to counteract the impact of the expected sales tax increase next year.

Latest FX News

EUR: Italy dominating proceedings in the early part of the week, with 10 year yields near to 4.70% as the government looks to be on very shaky ground. The single currency has lost ground versus most of the major currencies over the past week as a result.

JPY: USDJPY opening lower on the back of US political developments as the yen remains the safe haven of choice for the time being. USDJPY made a 1-month low at 97.53.

AUD: The short-term downtrend remains intact as risk aversion sees the Aussie briefly move below the 0.93 area in overnight trade. Weaker than expected HSBC PMI data from China also adding to the weaker tone, Australia still very much tied to the fortunes of the Chinese economy.

Further reading: