Technical Bias: Bullish (Medium Term)

Key Takeaways

- US dollar continued its slide against the Canadian dollar.

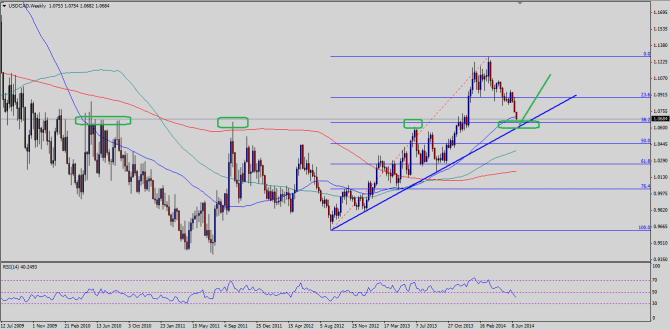

- Ahead, the USDCAD pair is approaching a monster support area which might result in a bounce.

- USDCAD support seen at 1.0620 and resistance ahead at 1.0820.

The US dollar struggled to hold an important range support area at 1.0800 and traded lower against the Canadian dollar. However, it is now heading towards a key support area where buyers might appear again.

Importance Of Weekly Trend Line

There is a monster bullish trend line on the weekly timeframe for the USDCAD pair, which has acted as a swing support on numerous occasions. The pair is again approaching the same trend line. This time the trend line holds a lot more importance, as the 38.2% Fibonacci retracement level of the last major leg from the 0.9630 low to 1.1271 high is coinciding with the mentioned trend line. So, the Canadian dollar buyers might struggle around the mentioned confluence support zone.

However, there are two things which might go against the US dollar buyers in the medium term. First, the USDCAD pair is flirting with the 50-weekly simple moving average, and a close below the same might encourage sellers moving ahead. Secondly, the weekly RSI has breached the 50 level, which is again a warning sign. So, we need to be very careful, as if the pair gains momentum, then it might easily break the trend line support area. In that situation, the pair might head towards the 50% fib retracement level at 1.0440.

Alternatively, if the pair manages to avoid a break, then it might bounce back sharply towards the last range support area at 1.0800, which could act as a resistance moving ahead.

Canadian Industrial Product And Raw Materials Price Index

The Statistics Canada is scheduled to release two price indexes later during the NY session – Industrial Product and Raw Materials Price Index. Both the indexes are expected to register an increase. Let’s see how the Canadian dollar reacts post the data release.

For more see the Canadian dollar prediction.