The British Pound has been one of the most heavily sold currencies in 2015, and forex traders are still waiting for an indication that these bearish trends have run their course. But when we look at the British economy from a broader perspective, there is a clear case that can be made for further weakness in cable. Specifically, consumer inflation levels have fallen to their lowest levels in recent memory — and this is likely to prevent the Bank of England from increasing interest rates any time in the near future.

This is not something that can be said of the United States, where rising employment and consumer spending has put upside pressure on consumer inflation. because of this, the Federal Reserve is much more likely to start raising interest rates before the end of the year when we compare the outlook that is now expected at the Bank of England. These differences in the potential for yield advantage should continue to support the greenback and drive down valuations in the GBP/USD.

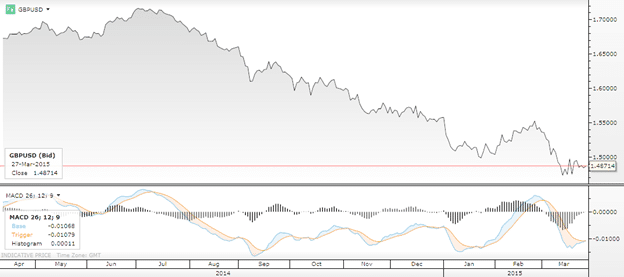

For all of these reasons, it will be important for forex traders to continue monitoring the GBP/USD for new technical developments in the pair. It is true that the GBP/USD has already seen some tremendously bearish moves, but there is still the potential for further declines once we consider the changing nature of the interest rate differential in both regions. Here, we will look at the latest chart activity in the pair so that we can identify some important support and resistance levels that might be used for forex trades.

GBP/USD – British Pound vs. US Dollar

Critical Resistance: 1.5525

Critical Support: 1.4730

Trading Stance: Sell on Rallies

(Chart Source: CornerTrader)

GBP/USD Forex Strategy: Downside momentum prevails but we are approaching oversold territory on several indicator readings.

The broad downtrend in the GBP/USD continues, and traders will need to exercise some level of patience in establishing new short positions. So while it might seem tempting to jump right into the downtrend, it is a much better idea to wait for some corrective rallies in order to get a better deal on the trade and to more properly structure risk to reward ratios in ways that are solidly in your favor. At the moment, important support can now be seen at the 1.4730 location and there is still some potential to start seeing a corrective bounce out of this support zone. A move like this would actually be beneficial for bearish traders as this will allow for better trade entries in order to capitalize on the long term downtrend.

In all of these ways, we can see that the potential for reversal in the GBP is not very encouraging. Contrarian traders are probably looking for support levels to use as a basis for long entries but when we look at the broader momentum and the fundamental outlook for the pair, that outlook starts to change.