2015 is just about to end and 2016 is around the corner.

Here is the view from Credit Agricole:

Here is their view, courtesy of eFXnews:

The tug of war between central bank policy divergence and global currency wars should continue to drive price action in G10 FX markets next year. The relatively strong domestic fundamentals in the US and the UK should allow the Fed, and to a degree the BoE, to tolerate further currency appreciation against low-yielding funding currencies like EUR, CHF and JPY.

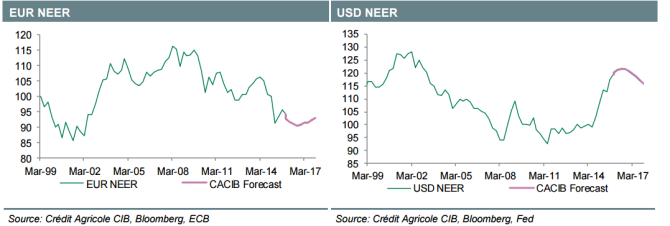

With many positives in the price, we expect both USD and GBP to peak next year. In the case of USD NEER the peak should come towards the end of 2016 once the Fed tightening cycle is well underway. GBP should fare less well and we expect renewed weakness in H216 ahead of the EU referendum.

Policy divergence should keep EUR/USD and EUR/GBP under pressure. EUR should remain relatively more resilient against risk-correlated and commodity currencies as well as CHF and JPY. We expect EUR/USD to trade through recent lows in 2016 but parity is not our base case. The cyclical recovery in the Eurozone should accelerate and ultimately limit the scope for aggressive easing by the ECB, paving the way for a EUR rebound in late 2016 and 2017.

The risks to global growth and inflation should linger and prolong the global currency wars.Worries about China in combination with tighter global monetary conditions on the back of Fed tightening should continue to darken the outlook for G10 commodity and risk-correlated currencies. In that, we expect the antipodeans to underperform CAD and NOK. SEK should outperform but only once the Riksbank has declared an all clear on the risk of deflation later in 2016.

CHF and JPY should be the biggest underperformers in 2016. Persistent threats of deflation in Japan and Switzerland, as well as significant currency overvaluation in the case of the CHF, should mean the markets continue to bet on further BoJ and SNB easing. In addition, unhedged portfolio outflows from Japan and Switzerland could intensify as USD-hedging costs increase in tandem with US short-term rates. That should boost both USD/JPY and USD/CHF.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.