Yesterday I was discussing with a fellow trader wanting to jump into the Forex market.

After trading the futures market for several years, he got more and more interested to get an understanding of the Foreign Exchange world.

Being a Forex trader myself (and loving to talk about it), I started explaining some of the basics of Forex trading as they relate to futures trading as well. One of particularities of the Forex market, however, concerns the reactions to the numerous news released every single day around the world.

Guest post by Etienne Crete of Desire To Trade

That fellow trader wasn’t used to news in the Forex market while any Forex trader knows news can completely change the direction of a currency. Understanding that simple fact is crucial.

Now, I’ve never been a fan of macroeconomic data, and I don’t believe understanding every move in the economy is useful for a Forex trader. However, understanding how news releases affect the market is a must.

I was fortunate enough to come across people who could guide me around the topic of news trading, including Yohay Elam, the founder of Forex Crunch.

The purpose of this article is to share some of the top lessons I’ve received about news releases trading. I do not want to take credit for those lessons but they helped me immensely. I’m putting a special emphasis on ensuring that those lessons are applicable to you, the fellow Forex trader.

Lesson #1: Looking At The News Releases Calendar Isn’t Optional For Forex Traders

I learned this the hard way”¦

Placing a trade slightly before a news release without being aware that the news is coming is a terrible idea.

In my experience, scheduled speeches & conferences are to avoid, because the movements prior and during those event are usually both ways and very volatile. It makes getting stopped out of a trade very likely.

Typical news releases, however, usually drive the price in a certain direction. It can go for you or against you. For that reason, I’m usually willing to stay in a trade during a news release given that my stop loss is wide enough and that I’m targeting a longer-term movement.

Lesson #2: You Must Choose Your Currency Pair Wisely

One thing you’ll notice in Forex is that news releases for certain countries are often released at the same time.

The Non-Farm Payroll (United States), for instance, can be released at the same time as the Employment Change in Canada. That makes it really tricky to trade Non-Farm Payroll through the USD/CAD pair.

An alternative might be to trade the EUR/USD, but traders must understand that the effect of the news release is likely to be high as EUR/USD is a very liquid pair (that was pointed out to me by Yohay Elam).

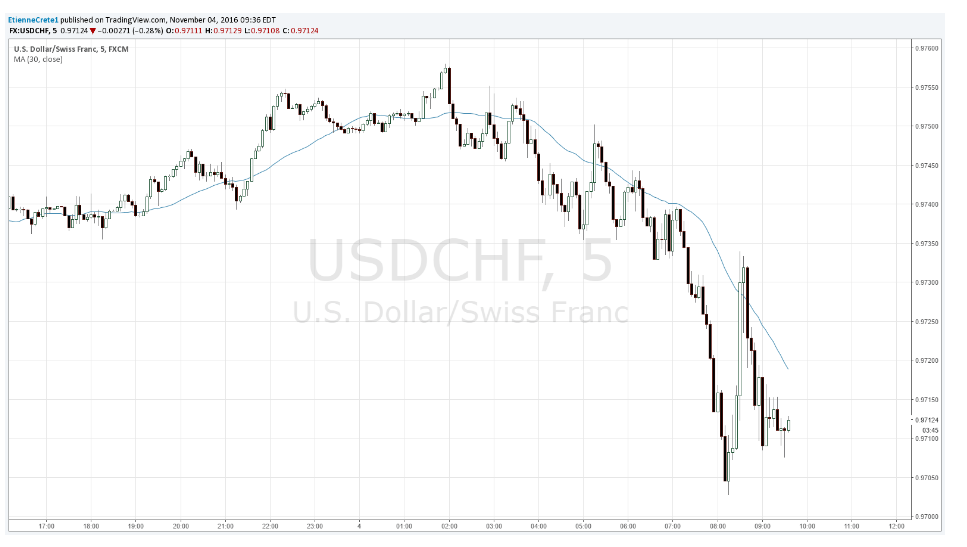

On the other hand, a fairly less liquid currency pair might offer a more temperate reaction. Such an example of pair is USD/CHF.

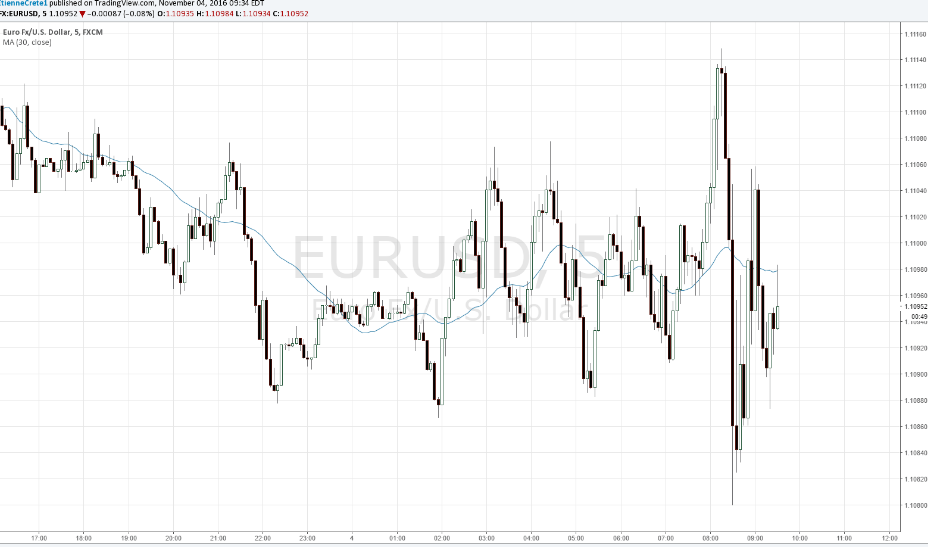

The difference in the move of EUR/USD and USD/CHF post Non-Farm Payroll are showcased below:

You may have spotted that USD/CHF was already in a trend prior to the news release and that the trend didn’t change.

The main take-away here is that you need to pick a pair that will have a reaction caused by a single news.

Then you want to trade a currency pair that is likely to react according to your preference. If you hate strong/sudden price reactions, stick to currency pairs that are slightly less volatile.

Lesson #3: Don’t React If You Aren’t Trading The News

Whenever a scheduled news release comes out, the impact will most likely last for some time and then fade away (that was also pointed out to me by Yohay Elam).

After a strong reaction in price, however, a lot of traders get stressed and act on that impulse and make irrational decisions.

If you entered a trade and the price starts going against you due to a news release, don’t panic.

What you usually want to make sure, however, is that your stop loss has been placed far enough to accommodate the fluctuation of the news.

If you trade smaller time frames on very tight stop losses, you are much better staying outside the market when news is released.

Conclusion

To conclude, I’ve seen great improvements in my trading by following the three lessons highlighted above. Implementing those lessons the right way will definitely help you stand above struggling Forex traders, but do not forget that what matters even more is the personal style you develop as a trader.

The rules mentioned above aren’t fixed and you can break them, but first think about how logic it is to break a rule prior to breaking it.