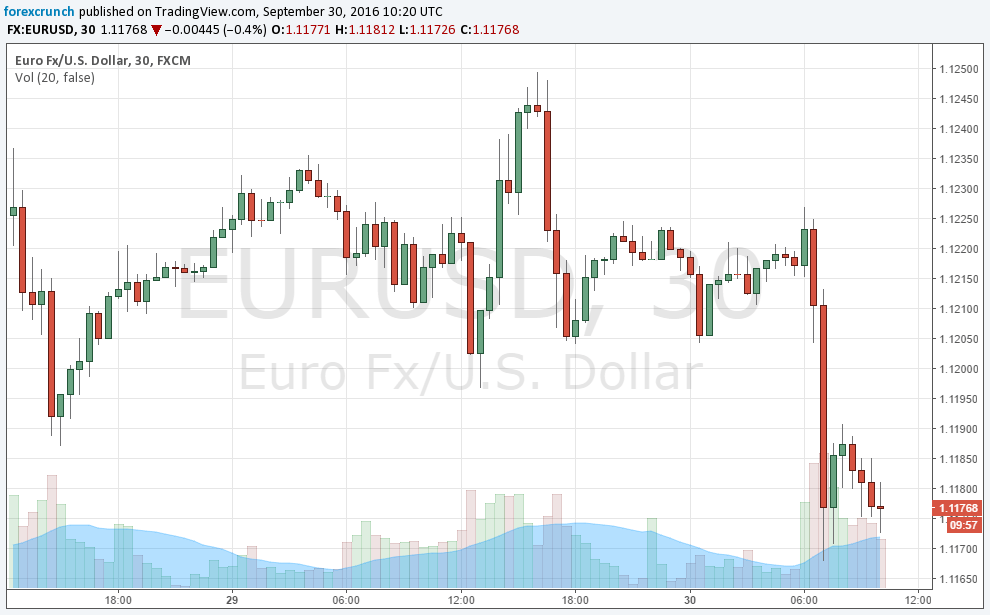

EUR/USD is on the move. No, we do not have a breakout out of range, but the slide is more significant than in previous days. The pair is trading at 1.1170, down some 50 pips on the day.

Here are three reasons for the fall.

- Deutsche Bank: The beleaguered German bank’s shares continue falling. Almost every day brings more misery to the big institution. The recent blow was a hefty fine that was imposed by US authorities, but this joins other issues. ECB President Mario Draghi dismissed the accusation in some circles that low rates are to blame. Deutsche Bank is not alone: other banks are also suffering, and any solution could be a precedent for other banks. A direct state bailout is officially forbidden, but everything is possible in Europe.

- Low inflation: Europe is not in deflation and the prices have even accelerated to 0.4% year over year. The base effect of falling oil prices is diminishing. However, the deeper problem is core inflation, which refuses to budge. It remains at 0.8%, below expectations and shows the underlying drag on prices. This could imply further action from the ECB.

- Unemployment is rising: The jobs market in the euro-zone was quietly improving, serving as one of the brighter spots, as growth remained weak and inflation elusive. A fresh report was disappointing: a rise in the unemployment rate to 10.1%.

EUR/USD has support at 1.1120, which is a double bottom. Further support is only at 1.10. Resistance awaits at 1.12280 and 1.1370.

More: EUR/USD: Struggle Between Bulls And Bears Drags On: Levels & Targets – JP Morgan