The Reserve Bank of Australia has already opened the door to a rate cut in August. Yet a lot depends on the inflation data. The team at DB says stay bearish:

Here is their view, courtesy of eFXnews:

Ahead of this week’s inflation data, there are three main reasons to stay short AUD, whether against an equally weighted G3 basket or just against EUR, as we recommended last week.

First, an August rate cut still looks underpriced at 60%. Our economists expect core inflation for Q2 at 0.4% q/q and 1.5% y/y. While this is consensus, we believe the RBA’s reaction to such a print will be more dovish than market pricing implies.

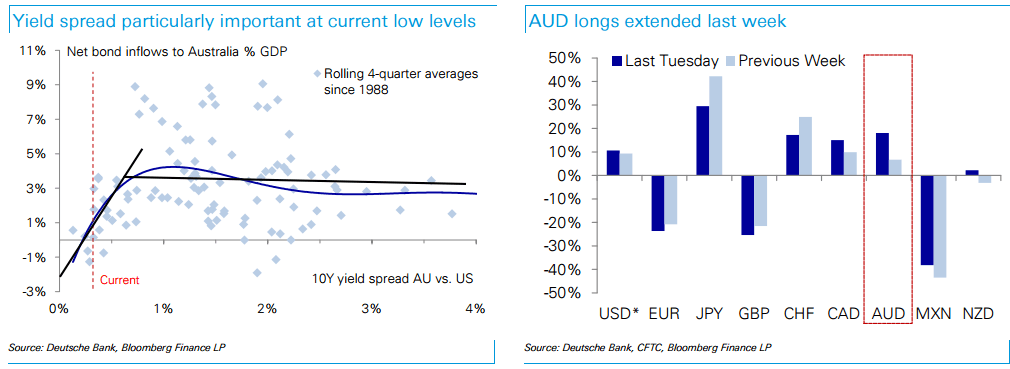

Second, after widening in June and early July, the 10Y yield spread to the US has narrowed again to 35bps, implying bond inflows will cease based on the historical relationship.

Third, positioning and valuation still favour shorts. Positioning data from last week’s IMM report, which captures the post-RBA minutes selloff, still show a large extension in net AUD longs. That position is at risk of a rapid reversal if the RBA displays greater urgency in easing than the market expects, especially since longs are concentrated in the leveraged community seeking short-term carry rather than value.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.