Pound/yen, also known as “the dragon” has seen a lot of action in recent weeks, and now the team at Deutsche Bank lists 3 reasons to sell this cross.

Here is why it provides a nice medium term trade:

Here is their view, courtesy of eFXnews:

In a note to clients today, Deutsche Bank presents a multi-year trade that should work irrespective of China, the ECB or Fed:

“Short GBP/JPY. We like selling the cross on a medium-term basis on the back of three major drivers,” DB advises.

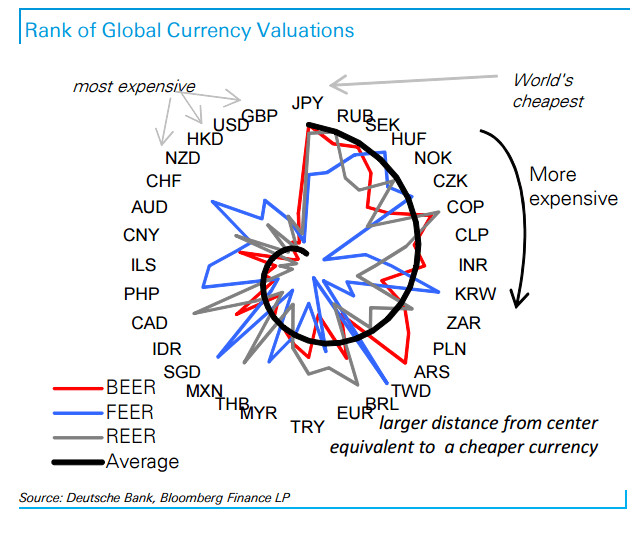

(1) GBP/JPY is the most expensive currency pair in the world. “Our “spider” chart below takes the average ranking of three different valuation metrics and ranks currencies accordingly. The JPY is the cheapest and GBP the most expensive currency in the world,” DB notes.

(2) UK in trouble next year. “The growth picture is holding up well and BoE pricing for a 2017 “lift-off” date is dovish. But things may be different as 2016 comes into play. The UK will be hit with the largest fiscal consolidation in the G10 because the government stopped deficit reduction ahead of this year’s election,”: DB adds.

(3) Dollar-yen running out of boosters. “Another round of BoJ easing may mark the peak in easing as the central bank will run out of JGBs to buy, the current account is turning back up and the GPIF reallocation trade is maturing as targets are approached,” DB argues.

How much can GBP/JPY drop? “Given past PPP over and undershoots, the cross has space to fall to 100 or below, a 50% drop from current levels,” DB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.