The US dollar made some recovery attempts, but things are not too bright for the greenback. Here are 4 reasons to remain positive on USD:

Here is their view, courtesy of eFXnews:

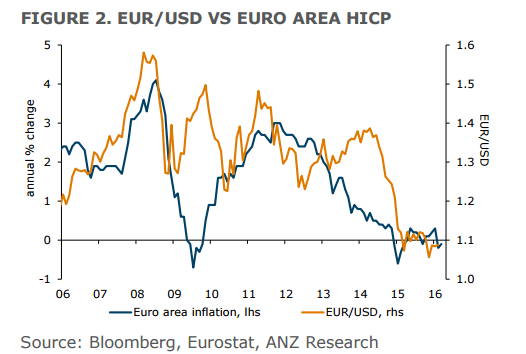

Although the commodity complex has been more stable recently and that has removed some downside pressure on the euro via the disinflation channel, we anticipate that other factors will soon come into play.

First, the extent of dovish stance by the US FOMC in March took us by surprise. We had anticipated that it would cut the dot points for this year by 25bps, not 50bps. We regard the improvement in US core inflation (PCE +1.7% y/y, CPI 2.3% y/y) as more permanent than transitory. Interestingly, there have been a number of regional Fed presidents noting the improvement in US core inflation and pushing back against Yellen’s since the 15-16 March FOMC meeting. The US Fed, therefore, may be approaching the limits of dovishness.

Second, the US Fed is closely monitoring the global and financial market environment. If that consideration and the potential for elevated volatility from Fed hikes was a key reason why the dot points were cut in March, then the dollar could have to absorb some of the need for monetary tightening and start to re-appreciate.

Third, the ECB is planning to buy assets equivalent to 9% of GDP over the next year. That planned expansion in the ECB’s balance sheet and the impact of QE on yield curves (flatter) is not conducive to a sustained appreciation in the euro.

Fourth, the UK’s referendum on EU membership is providing an unsettled backdrop to the EU political landscape. If the UK elects to leave, that would be unambiguously negative for the EU and has the potential to precipitate knock-on referenda elsewhere. That would likely weigh on the EUR.

We therefore remain positively disposed towards the USD in the coming months despite the recent prolonged period of consolidation. Before a major turn in EUR/USD can occur, we feel that evidence that euro area inflation is sustainably returning to target will be needed.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.