While the pound lifted itself after the big flash crash, it remains vulnerable. The team at Goldman Sachs sees big fall ahead:

Here is their view, courtesy of eFXnews:

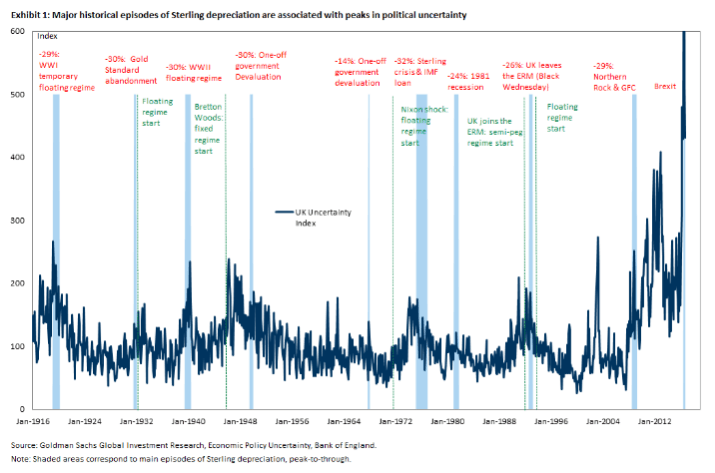

With the prospect of a ‘hard Brexit’ becoming a reality, investors who were previously expecting a ‘soft’ Brexit, or no Brexit at all, have updated their priors, and Sterling has depreciated about 5 percent over the space of a week against G10 currencies. GBP/$ is about 1.5 percent above 1.20, which is our 3-months forecast published on 5 July 2016.

We quantify the magnitude of a potential further fall in the Pound. Based on our benchmark model that assesses the impact of political uncertainty on currencies, the cumulative depreciation of Cable could be as large as 25 percent by year-end, an additional 7 percent decline from its current value.

While this estimate is subject to the usual degree of model uncertainty and should be viewed with a degree of caution, the following additional considerations lead us to think that such a downside move in Sterling is quite likely to materialize over the next couple of months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

First, while difficulties and hostilities around the process of negotiating Brexit have come to the forefront in the past week, in our view, the negative news has not yet been fully reflected in FX.

Second, we expect data to deteriorate over the next year, surprising more to the downside than it has done so far, also weighing negatively on the currency.

Third, we expect that monetary and fiscal policy will continue to place more weight on economic activity than on inflation; hence, policy news will be at worst neutral and at best negative for the currency.

Fourth, the repricing of a policy rate hike in December by the Fed and the USD strength associated with it can also contribute to Cable downside.

Finally, at the current juncture, we continue to think that, despite the large current account deficit, the UK will not face a balance of payments crisis of the type seen in emerging markets. A sudden stop of capital inflows forcing a much larger devaluation of the currency is unlikely, as long as the UK’s rule of law and institutions remain stable and business friendly. That said, even without a balance of payments crisis, we show below that there have been eight episodes in the UK where the currency depreciated by 25 percent or more over a period of less than a year, even though in many of these cases the exchange rate regime was either fixed or pegged, and the UK government either moved to a flexible regime or announced a one-off devaluation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.