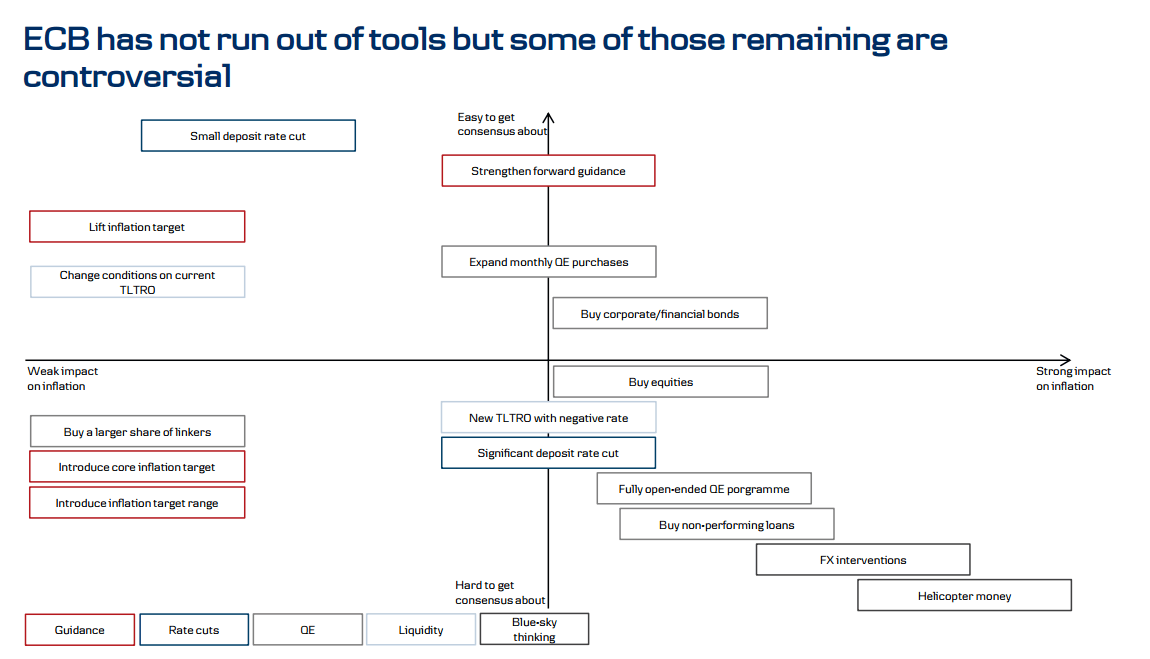

It’s ECB week. We know they are going to do something, but what can they actually announce? Here is the toolbox according to Danske:

Here is their view, courtesy of eFXnews:

We look at what is left in the ECB’s toolbox, how the remaining tools would support inflation and how they would affect markets across different asset classes. Our conclusions are based on the assumption that the ECB can support inflation through (1) lower yields and thus a lower cost of borrowing, (2) more liquidity and in that way more accessible loans to the private sector, (3) a weaker euro, which supports exports and gives higher imported inflation, and (4) improved confidence, which supports demand.

There are plenty of instruments left in the ECB’s toolbox but some of them are of a very non-conventional character. This said, only two years ago, cutting the deposit rate to negative and announcing a broad-based QE programme would have been seen by many analysts as very non-conventional.

The ECB’s remaining tools include the following.

1. Stronger forward guidance, which could include a different interpretation of the inflation target.

2. Additional and more aggressive rate cuts.

3. QE expansion in size or by including more risky assets such as corporate bonds, equities or even non-performing loans in the QE universe.

4. Provide additional liquidity and/or announce new (T)LTRO loans where banks can borrow at a negative rate.

5. Some tools that we consider ‘blue sky thinking’ such as FX intervention or providing ‘helicopter’ money.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.