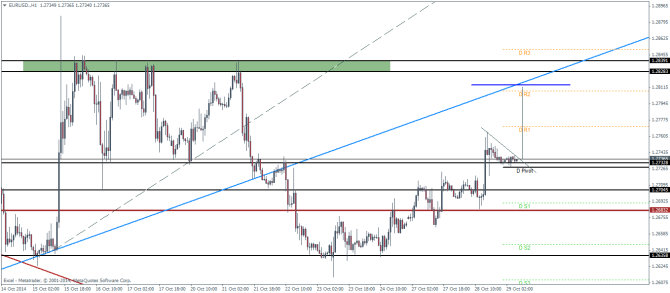

EURUSD Daily Pivots

| R3 | 1.2846 |

| R2 | 1.2808 |

| R1 | 1.2771 |

| Pivot | 1.2727 |

| S1 | 1.269 |

| S2 | 1.2647 |

| S3 | 1.261 |

EURUSD is currently consolidating pointing to an upside breakout. The rally to the upside is likely to hit resistance near the rising trend line and back towards the previously established resistance level of 1.2828 regions. We can see that EURUSD on the hourly charts has been consistently making higher highs and higher lows which adds validity to the upside bias.

USDJPY Daily Pivots

| R3 | 108.821 |

| R2 | 108.503 |

| R1 | 108.33 |

| Pivot | 107.981 |

| S1 | 107.839 |

| S2 | 107.521 |

| S3 | 107.282 |

After finding support near 107.75, USDJPY continues to look bullish. The inverted head and shoulders pattern gives an upside target to 108.935. Within the scope of the uptrend price channel, we can see that there is a lot of room for USDJPY to achieve this price objective. A break to the downside will see the price channel’s lower support line come in to hold price, failing which we could see steep declines to the downside towards 107.356.

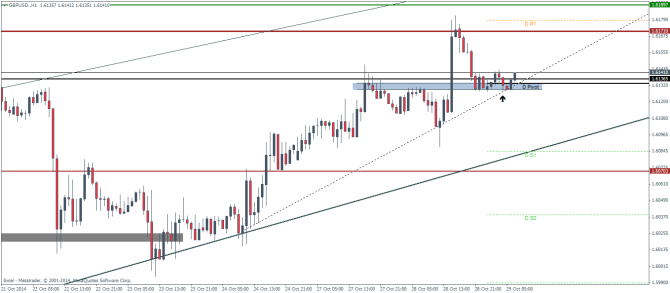

GBPUSD Daily Pivots

| R3 | 1.6266 |

| R2 | 1.6221 |

| R1 | 1.6178 |

| Pivot | 1.6128 |

| S1 | 1.6084 |

| S2 | 1.6034 |

| S3 | 1.5984 |

GBPUSD, after forming the bullish flag retraced its gains to start a rally again. However, the upside movements seem a bit limited with key resistance sitting at 1.617 and 1.618. A break of this level should see GBPUSD head towards the eventual resistance level at 1.627 and 1.629, which will be hard to break unless the previous resistance turns out to support prices.