The dollar had a strong week but the mixed Non-Farm Payrolls report certainly allowed for some profit taking. What’s next for the greenback?

The team at Goldman Sachs provide 3 factor that call for more conviction in the strength of the greenback.

Here is their view, courtesy of eFXnews:

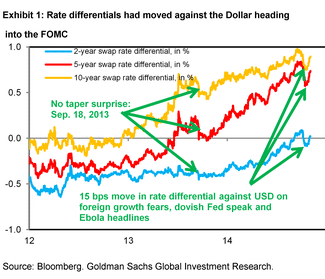

“It is three weeks ago today that the ‘growth scare’ was at its peak. Now that the dust is settling, we have learned [three] things.

First, the FOMC did not shift its stance in a dovish direction last week, despite several easy talking points (foreign growth, oil prices) for the taking. We see this as fundamentally Dollar bullish, in that uncertainty over the FOMC reaction function is diminished, while the US data flow has continued to be strong.

Second, places with low inflation have more to fear from a growth scare than the US. Last week’s surprise BoJ easing, which sees us revise our 12-month $/JPY forecast to 120 (from 115 previously), is a case in point.

Third, the drop in oil prices, which according to our commodity strategy team has somewhat further to run, is fundamentally Dollar-supportive. This is because lower oil prices shrink the current account deficit, reducing this ‘flow’ drag on the Dollar.

Overall, we emerge from the growth scare with more conviction in our strong Dollar view, although we are also glad that the scare is, increasingly, in the rearview mirror.”

Robin Brooks, Fiona Lake and Michael Cahill – Goldman Sachs

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.