EUR/USD briefly touched levels last seen a very long time ago, but then bounced. Is this a correction or just the initial move?

The team at BNP Paribas pick the latter scenario, explain and provide targets:

Here is their view, courtesy of eFXnews:

The stars are aligning to drive EUR lower with EUR/USD is the preferred candidate to maximise profitability, says BNP Paribas.

“EURUSD reached its lowest level since Q1 2006 at 1.1864. Concern over the upcoming Greek election on January 25 is a contributing factor but the real driver is falling inflation and hints from ECB members that direct policy action – namely sovereign QE – is imminent,” BNPP notes.

“Interviews published last week with both Draghi and Praet hint at our economists’ call for broad-based QE to be announced at the next policy meeting on January 22,” BNPP adds.

Along with that, BNPP notes that this morning’s much lower December CPI readings for the German Bundeslander are consistent with a lower German HICP today and also BNPP’s call for negative eurozone CPI on Wednesday (- 0.1% y/y).

“Both releases should weigh further on EUR if correct,” BNPP argues.

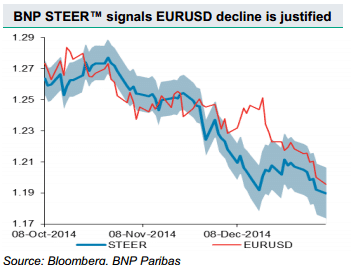

Finally, BNP Paribas Quant model ‘STEER’ model signals EURUSD at 1.1898 (see chart) suggesting that the fall is consistent with market fundamentals.

“We believe EURUSD will fall further…This week’s inflation readings are set to be the prime catalysts,” BNPP projects.

In line with this view, BNPP maintains a short EUR/USD in its portfolio from 1.2520 (entry on October 31) targeting a move to 1.18.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.