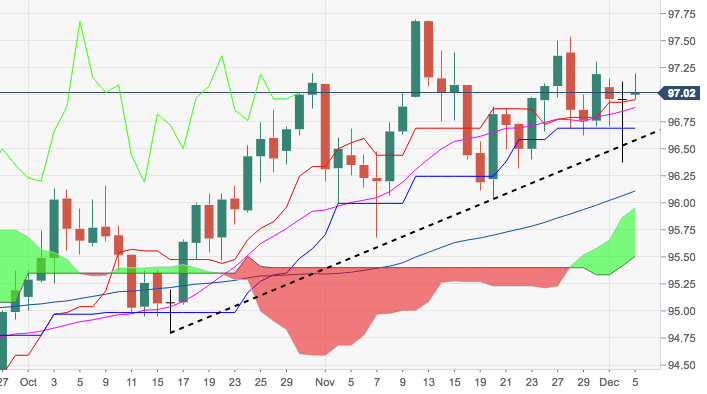

- Following yesterday’s deep pullback and test of the key support line, the index managed to rebound and retake the critical barrier at 97.00 the figure.

- Despite the bounce, the greenback stays somewhat vulnerable and another visit of the 96.00 neighbourhood is not ruled out in the near term. In this area emerge a Fibo retracement of the 2017-2018 drop and late-November lows.

- On the upside, there are no relevant hurdles until late-November’s peaks beyond 97.50.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 97.01

Today Daily change: 5.0 pips

Today Daily change %: 0.0516%

Today Daily Open: 96.96

Trends:

Previous Daily SMA20: 96.88

Previous Daily SMA50: 96.25

Previous Daily SMA100: 95.66

Previous Daily SMA200: 93.97

Levels:

Previous Daily High: 97.12

Previous Daily Low: 96.37

Previous Weekly High: 97.54

Previous Weekly Low: 96.62

Previous Monthly High: 97.7

Previous Monthly Low: 95.68

Previous Daily Fibonacci 38.2%: 96.83

Previous Daily Fibonacci 61.8%: 96.66

Previous Daily Pivot Point S1: 96.51

Previous Daily Pivot Point S2: 96.07

Previous Daily Pivot Point S3: 95.76

Previous Daily Pivot Point R1: 97.26

Previous Daily Pivot Point R2: 97.57

Previous Daily Pivot Point R3: 98.01