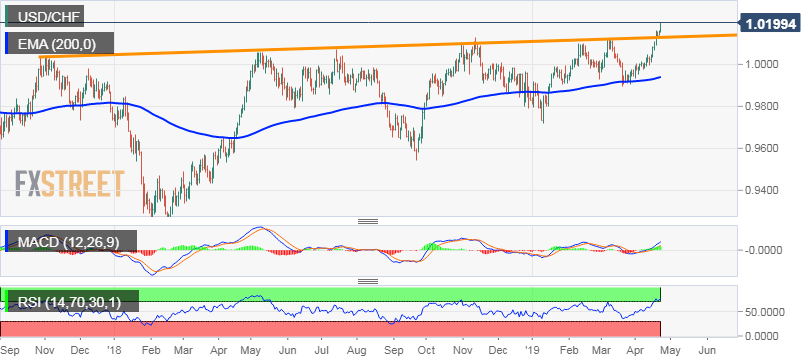

“¢ The pair built on its recent strong bullish trajectory from 200-day EMA and surged to the 1.0200 mark – the highest since Jan. 2017 during the mid-European session on Tuesday.

“¢ A sustained move beyond an ascending trend-line resistance, extending from Nov. 2017 swing highs, was seen as a key trigger for bullish traders and fueling the ongoing momentum.

“¢ Meanwhile, technical indicators on hourly/daily charts are already pointing to overbought conditions and might turn out to be the only factor keeping a lid on any follow-through up-move.

“¢ Hence, it would be prudent to wait for a brief consolidation/a modest pullback from higher levels before positioning for any further positive momentum towards reclaiming the 1.0300 handle.

USD/CHF daily chart