- Risk-off favors the Swiss Franc (CHF) strength.

- Two-month-old horizontal-area can question sellers.

Given the latest risk aversion helping Swiss Franc (CHF) over the US Dollar (USD), the pair is currently trading near 1.0140 ahead of the European open on Friday.

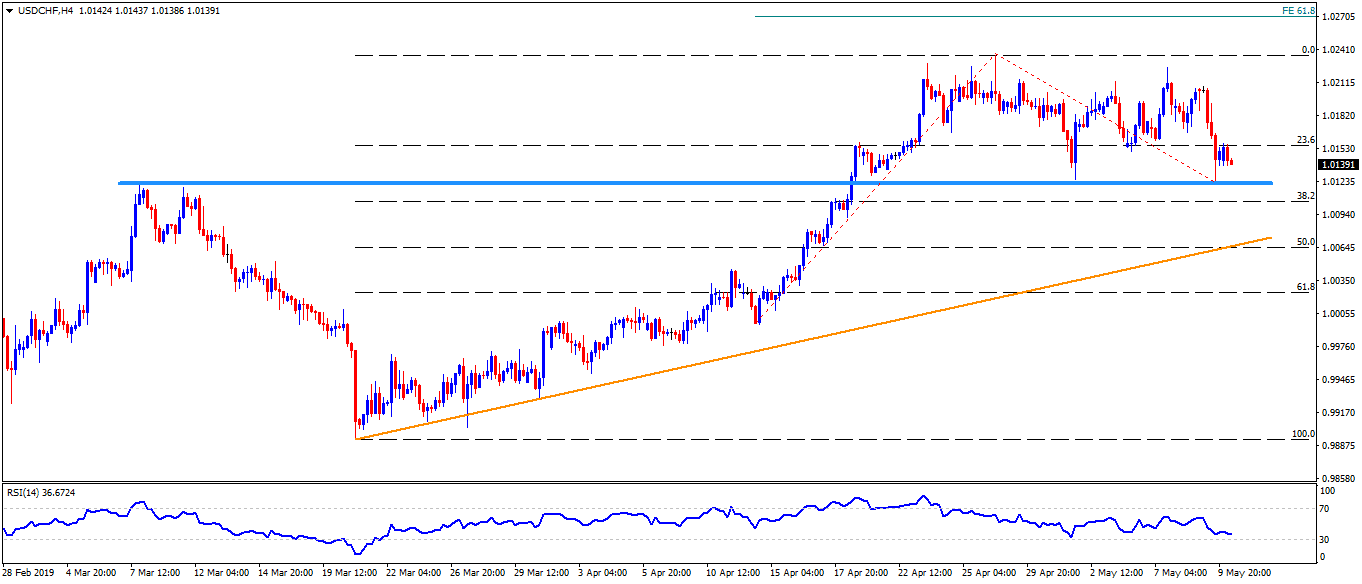

A horizontal-region near 1.0125/20 connecting early-March highs to lows marked since mid-April seems to be in the immediate attention of the sellers.

Should there be additional downside past-1.0120, an ascending trend-line stretched since March 20 could be of importance to observe around 1.0080 as it holds the gate to the pair’s slump to 1.0045 and 1.0000.

On the upside, 23.6% Fibonacci retracement of March to April rise at 1.0165 could offer immediate resistance, a break of which can trigger the pair’s recovery 1.0210.

During the quote’s rise above 1.0210, April high near 1.0240 and 61.8% FE level of moves since April 12, at 1.0270 now, may please the bulls.

USD/CHF 4-Hour chart

Trend: Bearish