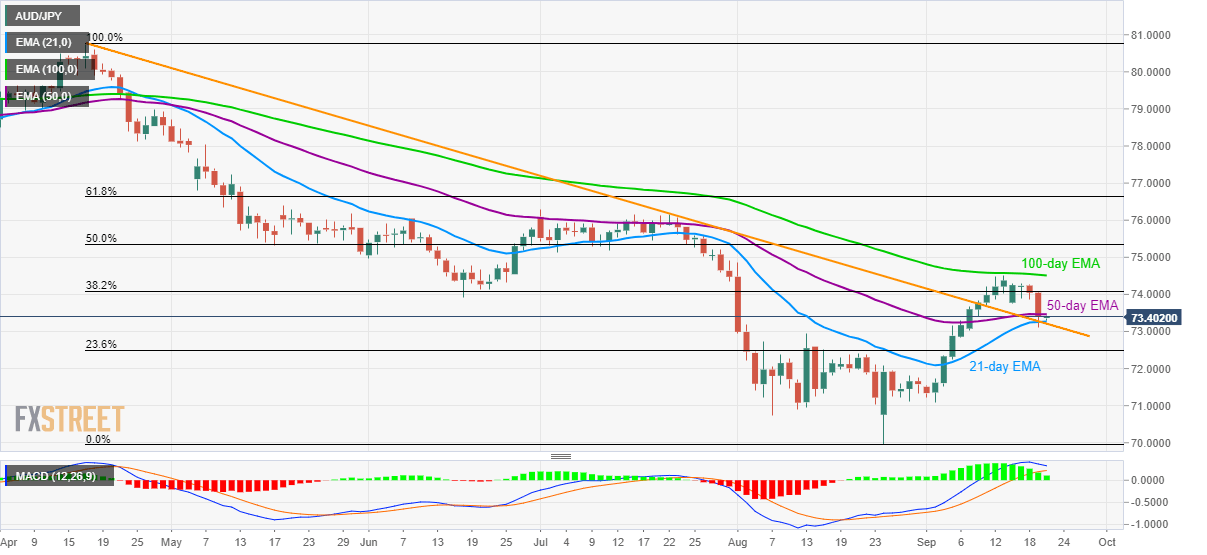

- AUD/JPY confronts 50-day EMA following a bounce off 21-day EMA, previous resistance-line.

- 100-day EMA adds to the resistance with 23.6% Fibonacci retracement occupying the other extreme.

Despite bouncing off short-term key support-confluence, AUD/JPY struggles to clear immediate exponential moving average (EMA) as it makes the rounds to 73.40 during early Friday in Asia.

The quote recently took a U-turn from 73.30/20 support-confluence including 21-day EMA and a five-month-old falling support-line (previous resistance). However, 50-day EMA near 73.50 seems to restrict immediate upside.

Should prices rise above 73.50, 38.2% Fibonacci retracement of April-August decline near 74.10 and 100-day EMA level of 74.50 could question buyers targeting 50% Fibonacci retracement around 75.40.

Alternatively, pair’s drop below 73.20 can revisit 72.50 rest-point comprising 23.6% Fibonacci retracement whereas 71.80 and multiple supports around 71.10/71.00 could entertain bears afterward.

AUD/JPY daily chart

Trend: sideways