- The cross is unable to maximise bullish attempts, weighed by risk-off markets.

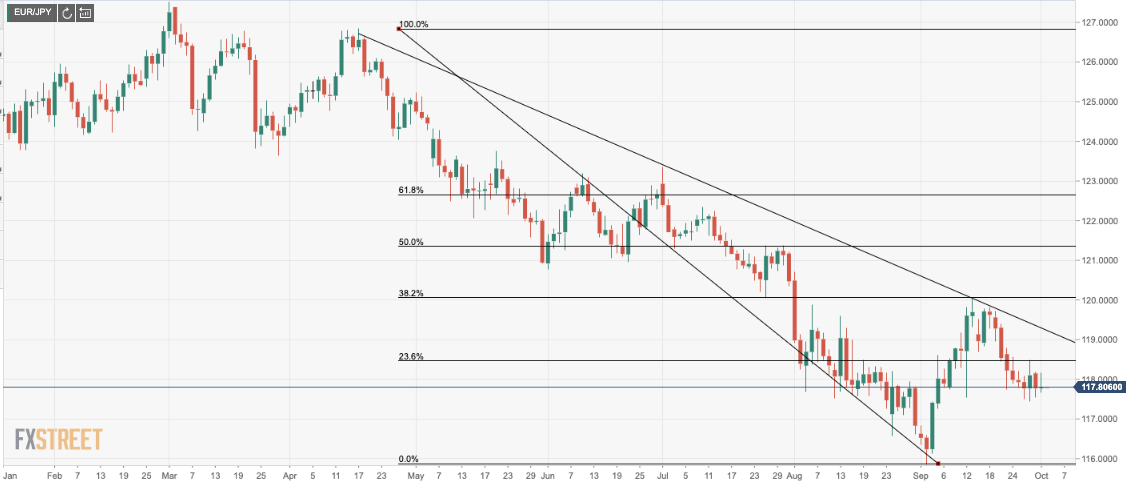

- Bulls capped at trendline and Fibonacci confluence.

EUR/JPY is pressured below trendline resistance and was capped at the 38.2% Fibonacci retracement level. The pair is trading between 117.71 and 117.82 in Asia, having lost the 118 handle overnight. The cross saw a strong recovery from support at the 117.55/52 August 12 and September 12 lows where bears aim to test yet again.

“Rallies will find resistance offered by the downtrend at 119.32 and this resistance is reinforced by 120.05, the 38.2% retracement. Very near term the intraday Elliott wave counts are neutral to positive and we may see a small rebound,” analysts at Commerzbank argued.

EUR/JPY daily chart