- DXY gyrates around the 98.00 mark, a tad below yearly high.

- The Fed left the Fed Funds unchanged, as expected.

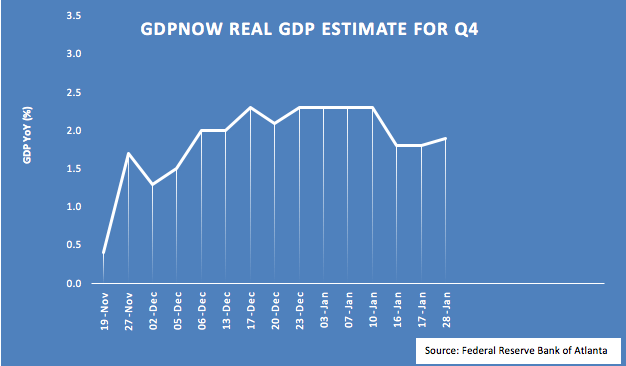

- Advanced Q4 GDP figures will take centre stage on Thursday.

The greenback is trading without a clear direction in the second half of the week, taking the US Dollar Index (DXY) to the 98.00 area ahead of the opening bell in the Old Continent.

US Dollar Index now looks to data

The index appears to have met some tough hurdle in the area of YTD highs beyond 98.00 the figure despite auspicious results from the US docket and in response to a somewhat dovish message from the FOMC at Wednesday’s meeting.

In fact, the Fed matched expectations and left the FFTR intact at 1.50%-1.75%, reiterating once again that the current monetary policy stance remains appropriate. In addition, the Committee revised up the Interest On Excess Reserves (IOER) and the reverse repo rate (RRP) by 5 bps in order to bring the Effective Federal Funds Rate (EFFR) closer to the midpoint of the FFR.

At his press conference, Chief J.Powell said the Fed is closely watching the events from the Wuhan coronavirus, adding that a change of the ongoing monetary stance would need a ‘material reassessment’ of the economic outlook.

Later in the US docket, advanced Q4 GDP figures are due seconded by usual weekly Claims.

What to look for around USD

DXY extended the recent breakout of the key 200-day SMA to the 98.00 mark and above, recording at the same time fresh yearly tops. Following the neutral/dovish message from the FOMC, investors are now focused on upcoming data and further developments from the Chinese coronavirus and its probable impacts on the global growth. The constructive view on the dollar, in the meantime, stays underpinned by the current ‘wait-and-see’ stance from the Fed vs. the broad-based dovish view from its G10 peers, auspicious results from the US fundamentals, the dollar’s safe haven appeal and its status of ‘global reserve currency’.

US Dollar Index relevant levels

At the moment, the index is down 0.04% at 98.04 and faces the next support at 97.71 (200-day SMA) seconded by 97.53 (55-day SMA) and then 97.09 (weekly low Jan.16). On the upside, a break above 98.19 (2020 high Jan.29) would aim for 98.54 (monthly high Nov.29 2019) and finally 98.93 (high Aug.1 2019).