- The Chinese economy most likely rebounded in the second quarter, yet government support is still needed.

- Factories have been keeping up, yet external demand is questionable.

- Consumers have been shy but their confidence has been rising, adding to the uncertainty.

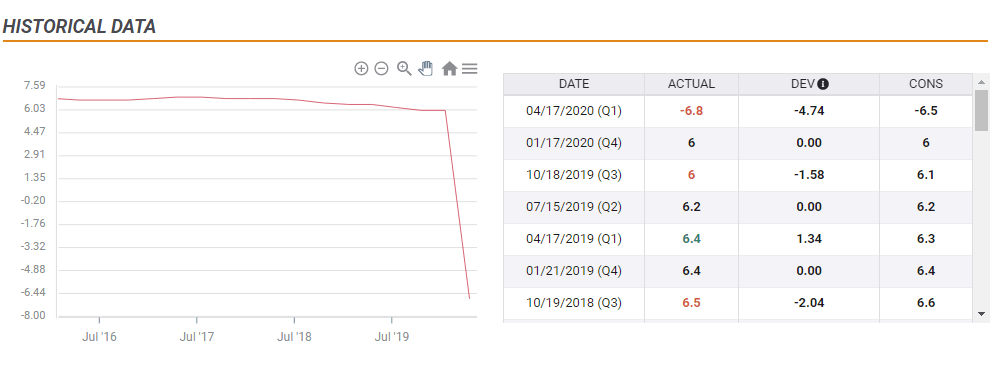

Comeback from coronavirus – but how much? China has surely bounced back in the second quarter, as the country opened up after the strict lockdowns imposed early in the year. After collapsing by 9.8% QoQ, the world’s second-largest economy has probably grown by 9.6% in the second quarter, according to a Reuters poll.

Is this quarterly comeback enough to put the country back to annual growth? After diving 6.8% yearly in the first quarter, the economic calendar is showing YoY of 2.1% in the second quarter.

How robust is the GDP rebound

Source: FXStreet

High uncertainty about the rebound depends on the impact of government support. While authorities have loosened lending conditions, Beijing has not taken drastic stimulus steps such as Britain’s furlough scheme or America’s check to every person.

If Gross Domestic Product growth is tepid, it could result in more support from the People’s Bank of China. Will bad news turn into good news? That would require a sub-zero annual growth rate. Many suspect Beijing “massages” the data – pushing figures higher to present a picture of success. Even if that is not the case, investors may dive into the details,

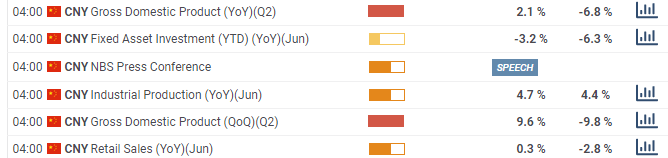

The headline GDP figure depends on two factors – consumption and production, and figures for June are published for both sectors.

Watch industrial output and retail sales

Industrial output is forecast to have risen at an annual rate of 4.7% in June, up from 4.4% in May. While factories have been keeping up – suffering only a minor dip even in China’s worst days – they also demand on external demand.

Europe suffered the worst of the disease in March and April and is now recovering. On the other hand, the US emerged rapidly from the initial shock but coronavirus cases spiraled again from mid-June. That may have been a drag on Chinese output.

The third uncertainty is around consumption. Authoritarian China may have persuaded or coerced workers to go back to factories, but it is harder to urge people to shop and dine outside.

Data from earlier in the year showed a significant hit to retail sales, and they are finally projected to return to the positive ground in June – an annual increase of 0.3% after falling by 2.8% in May.

Market reaction

Investors are set to initially react to the headline figure. Economists’ forecasts range from an annual contraction of around 3% to an expansion of around 4%. The consensus of 2.1% is, therefore, based on a wide array of opinions.

Stocks will likely cheer a robust GDP figure, despite suspicions about the veracity of the data. Slow growth would be disappointing, potentially sending shares in Shanghai and S&P 500 futures lower.

If Beijing shocks by reporting another quarter of annual contraction, markets may expect more stimulus and react in a counter-intuitive manner – rising on such stimulus hopes rather than falling.

Industrial output figures will likely be the second thing to watch, with a more pronounced impact on the Australian dollar. While job figures from the land down under are published around the same time, Australia’s No. 1 trading partner has an impact on the Aussie.

Last but not least, China’s retail sales are also significant. Investors will want to see how a country emerging from coronavirus is returning to normal.

Conclusion

China’s data dump – especially GDP – will be closely watched and is set to impact the market mood. A beat will be cheered while mediocre figures may weigh on the sentiment. In the unlikely case of horrible statistics, expectations for stimulus could turn positive for markets.