- GBP/JPY begins the week with an upside gap over 130 pips.

- EU, UK agrees to “go the extra mile” by continuing talks into this week.

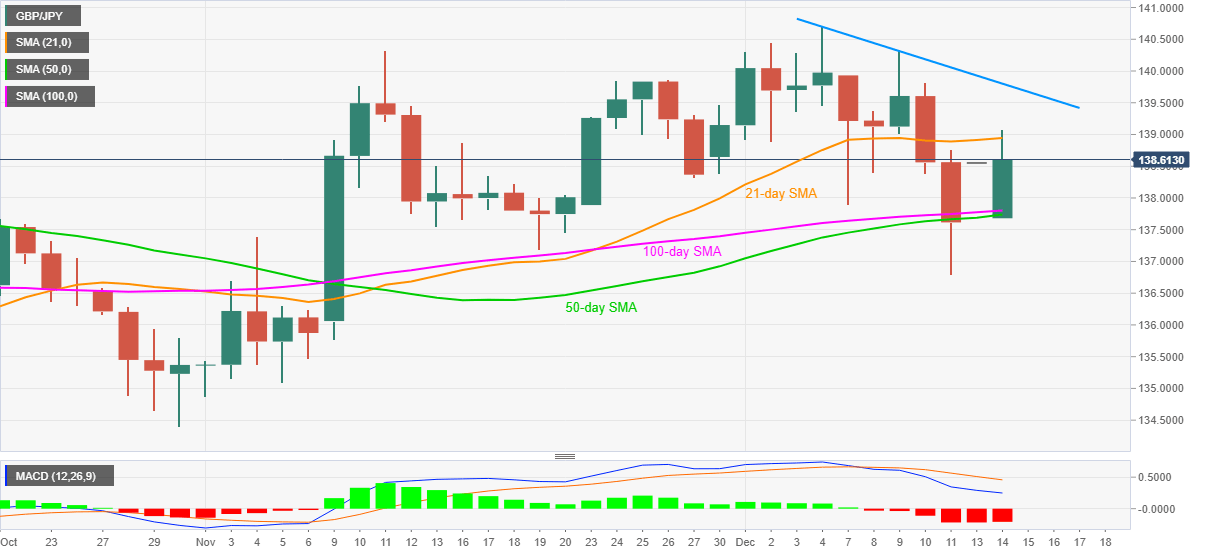

- One-week-old resistance line adds to the upside barrier.

GBP/JPY kick-starts the week’s trading with the gap-up to 139.00, currently around 138.53, during the early Monday in Asia. The pair recently benefited from the news that European Commission (EC) President Ursula von der Leyen and UK PM Boris Johnson agreed to extend Brexit talks to this week after conveying their “far apart” status the previous day.

Read: Brexit “still has some legs”, US bipartisan group devides stimulus into two packages

While the upbeat news triggered the quote’s U-turn from 50-day and 100-day SMA, it is yet to cross 21-day SMA, needless to mention the falling trend line from December 04.

With the MACD signals staying red despite the recent uptick in GBP/JPY prices, bulls are less likely to keep the helm unless posting a daily closing beyond 21-day SMA, currently around 138.95.

Also challenging the GBP/JPY bulls that target to refresh the monthly high of 140.70 is a short-term resistance line, at 139.80 now.

On the contrary, a daily closing below 50-day and 100-day SMA confluence near 137.80/70 will direct the GBP/JPY sellers towards October’s low around 134.40.

Though, Friday’s bottom surrounding 136.80 will challenge the bears during the stated south-run.

GBP/JPY daily chart

Trend: Pullback expected