- EUR/USD gathers traction and retests the 1.2050 area.

- The dollar loses momentum and breaches 91.00.

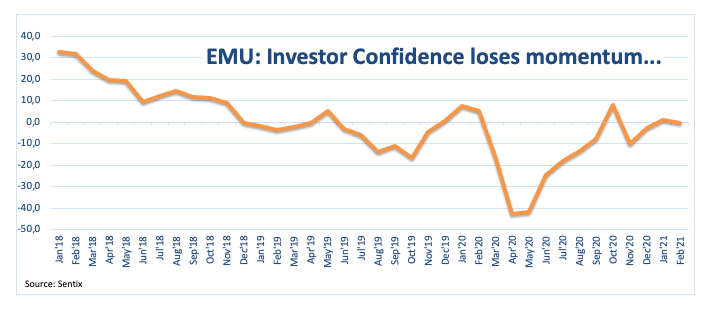

- EMU’s Sentix index disappointed expectations in February.

The single currency regains the smile and pushes EUR/USD back to the positive ground around 1.2060/65 on Monday.

EUR/USD now looks to ECB

EUR/USD now adds to Friday’s moderate advance and manages to leave behind the initial pessimism, looking to extend the rebound to the 1.2060 region, where coincides a Fibo level (of the November-January rally).

The move higher comes amidst the improved tone in the risk complex, with US stock indices hitting new record highs and yields receding further from daily tops, all weighing down on the buck.

Earlier in the euro docket, Germany’s Industrial Production lost momentum in December (0.0% moM) , as well as the investors’ confidence tracked by the Sentix Index in February (-0.2).

Later in the European evening, ECB’s C.Lagarde will participate in a debate in the European Parliament.

What to look for around EUR

EUR/USD seems to have met decent contention in the YTD lows around 1.1950 so far. In spite of the recent correction lower, the outlook for the pair remains constructive in the longer run and is always supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB along with hopes of an acceleration in the vaccine rollout. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

Key events this week in Euroland: Lagarde will speak on Monday and Wednesday. German final January CPI (Wednesday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention on inflation issues. EU Recovery Fund. Italian politics. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.11% at 1.2061 and a break above 1.2106 (21-day SMA) would target 1.2119 (55-day SMA) en route to 1.2189 (weekly high Jan.22). On the other and, immediate support emerges at 1.1952 (2021 low Feb.5) seconded by 1.1887 (61.8% Fibo of the November-January rally) and finally 1.1694 (200-day SMA).