- USD/JPY on the bid as the market factor sin rising inflation prospects and a Fed taper.

- 10-year yields reached new highs since Feb 2020 at 1.61%, before dropping to 1.54%.

USD/JPY has been trading between a range of 106.13 and 106.43 on Friday following a series of domestic data events and action on Wall Street.

there was a rally in the greenback and again in Asia due to the pace of the selloff in US treasuries that has increased sharply despite dovish comments from the Fed.

Bonds yields are going up because there is a massive supply of bonds and expectations of rising inflation. ”The rise in treasury yields was led by a poor result in the 7-year Treasury note auction and expectations that the Fed may push forward rate hikes,” analysts at Westpac explained noting the price action as follows:

”The 2-year bond yields were up 6 bps to 0.19% before falling down to 0.16%, 5-year yields reached 0.75% (highest since March 2020) and 10-year yields reached new highs since Feb 2020 at 1.61%, before dropping to 1.54%.”

Huge US deficits can’t be funded by the Fed entirely and there is now no buyer for the extra bonds.

Real yields are negative and there is little demand for negative yielding US treasuries as they are now not demanded as a safe haven.

This sentiment is creeping its way back into markets and this can lead to sell-offs on Wall Street.

In fact, the US stock market did slide on the auction, initially led by the NASDAQ and tech before both the Dow and S&P followed suit.

Nevertheless, the US dollar is higher as it has garnered strength in the belief that the Fed will have to start tapering sooner than preferred.

USD/JPY levels

Meanwhile, from a technical perspective, USD/JPY is heading deeper into the supply zone and is due for a weekly retracement.

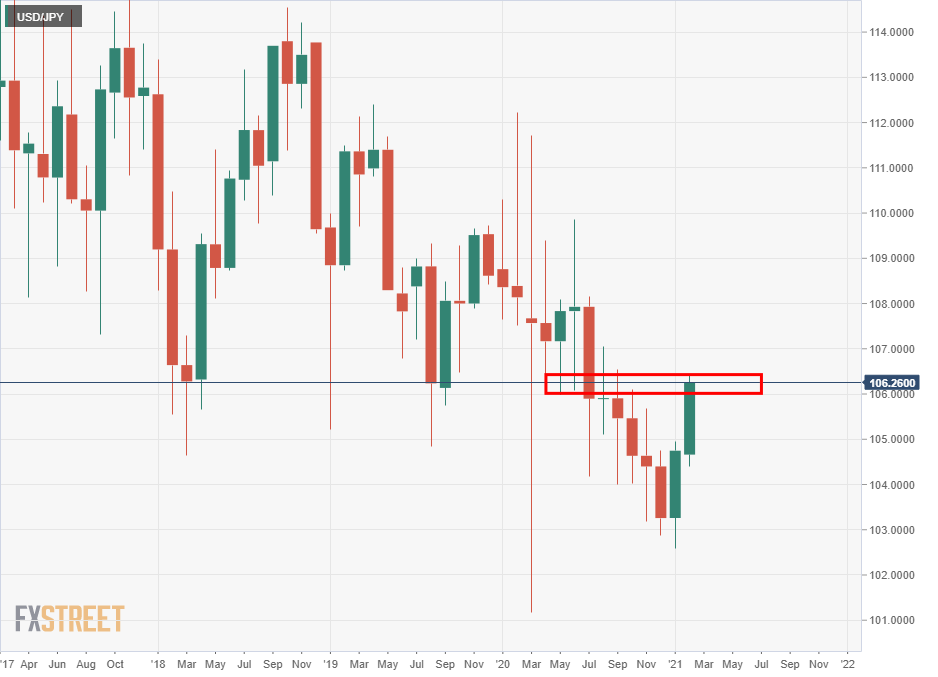

Monthly chart

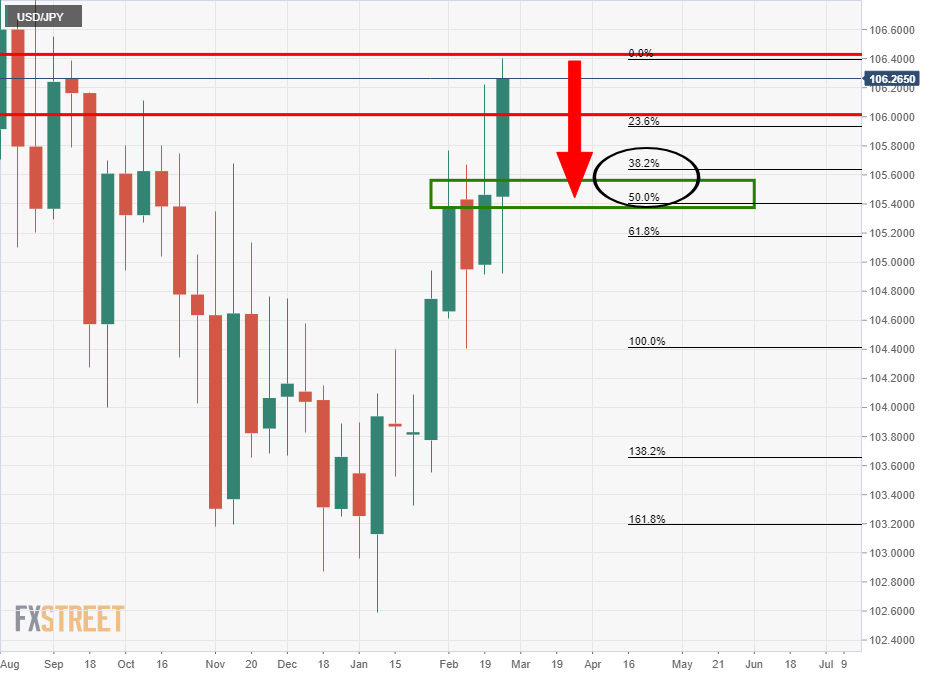

Weekly chart

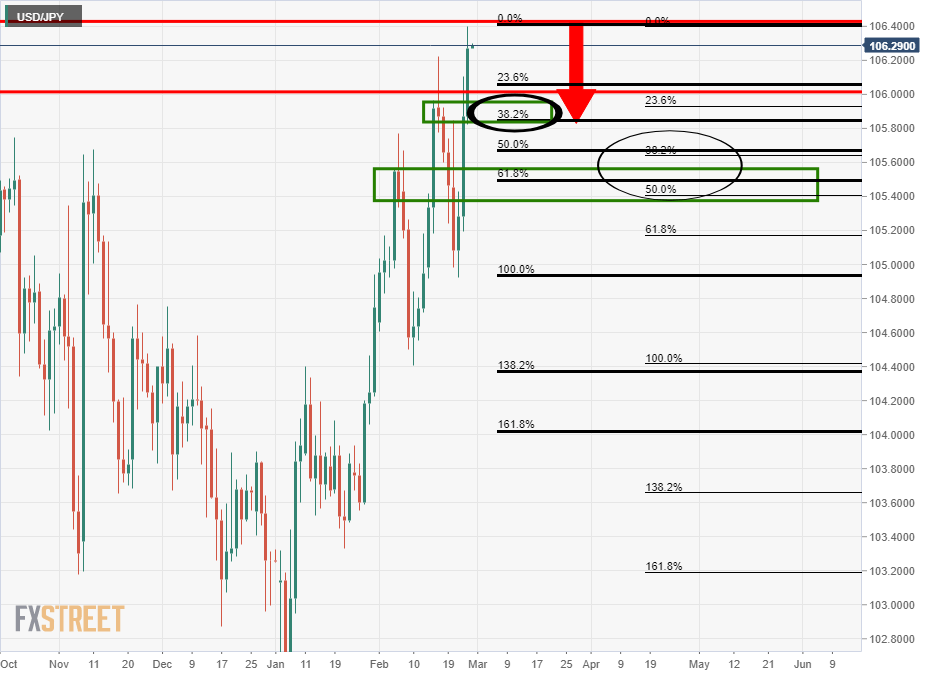

Daily chart

The daily chart offers a 38.2% Fibonacci retracement prospect that aligns with the prior resistance as an initial downside target.