-

Gold prices are challenging the bull’s commitments at critical daily support.

-

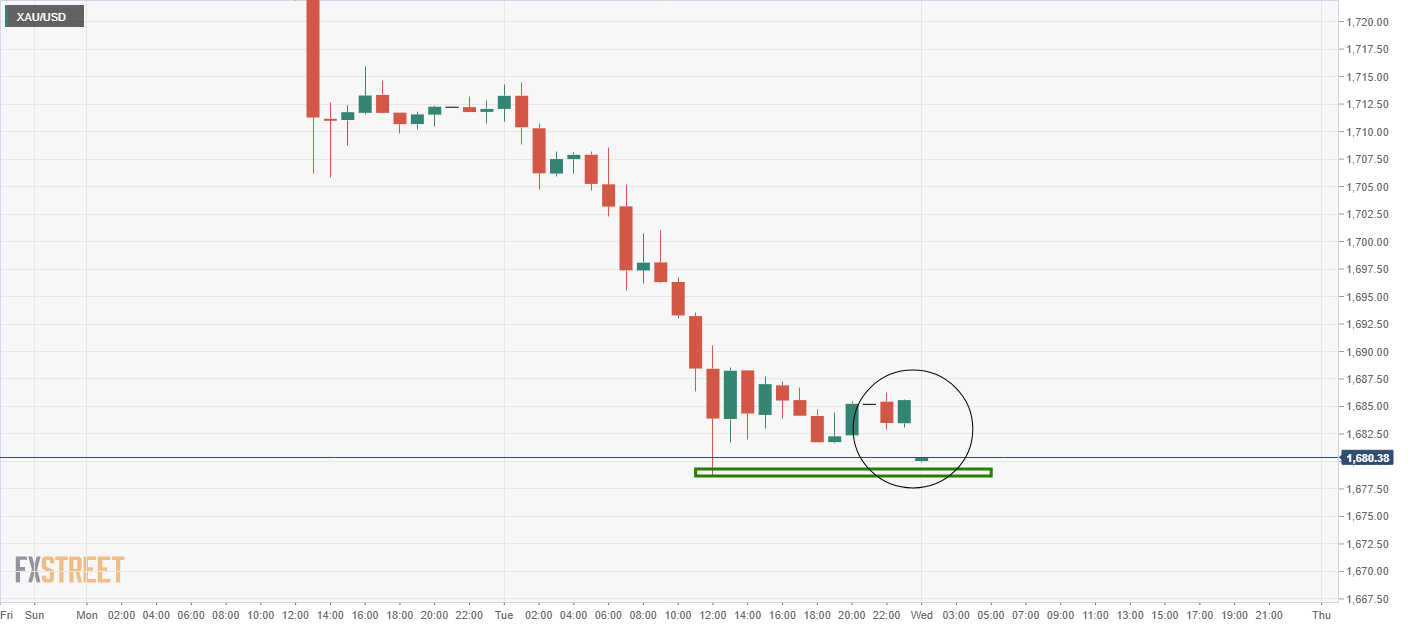

A fresh low in Asia and month-end squaring is in focus.

As per the prior analysis, Gold Price Analysis: XAU/USD bears taking control, eyes on a breakout, &, Gold Price Analysis: XAU/USD suffers at the hands of the US 10-year yield spiking, and more recently, Gold Price Analysis: Bears attacking critical weekly support, the bears are keeping the momentum going in Asia.

The prices have printed a fresh low for the session of $1,680.71 as it embarks on a test of the London lows of $1,678.77.

1-hour chart

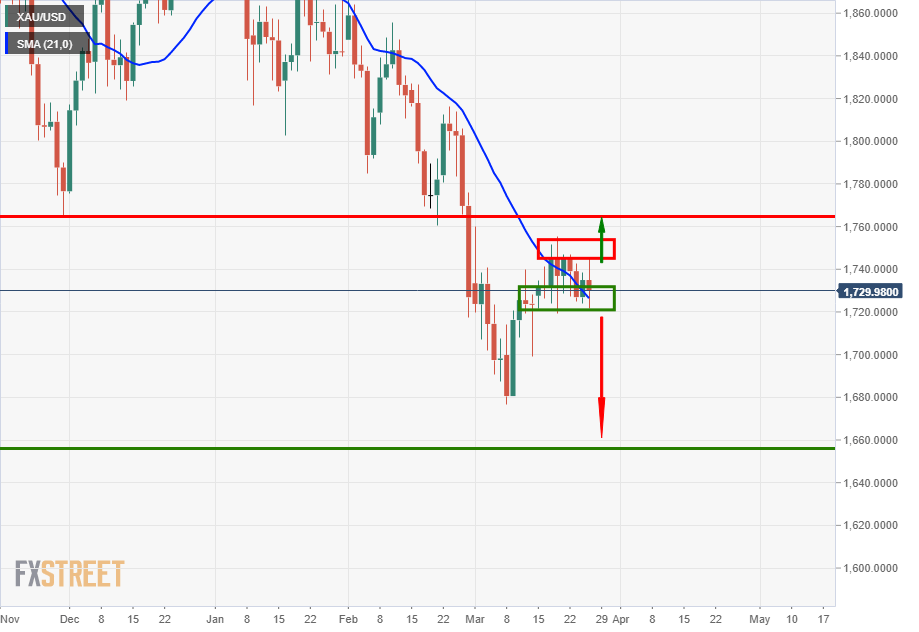

Meanwhile, the weekly remains bearish and the following illustrates the playbook to the downside:

Prior analysis, daily

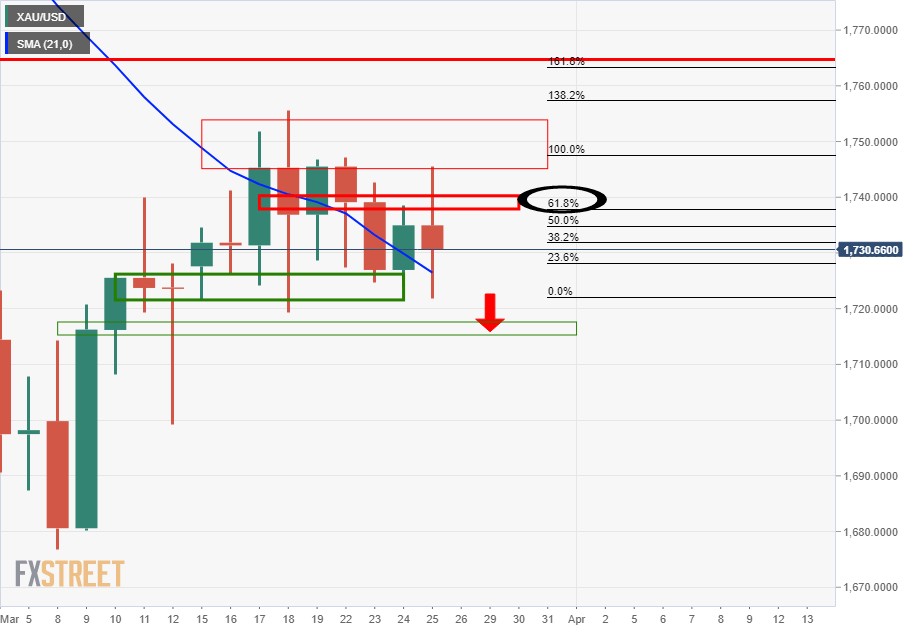

As can be seen, the price remains trapped, but there is a bearish bias within the channel as follows:

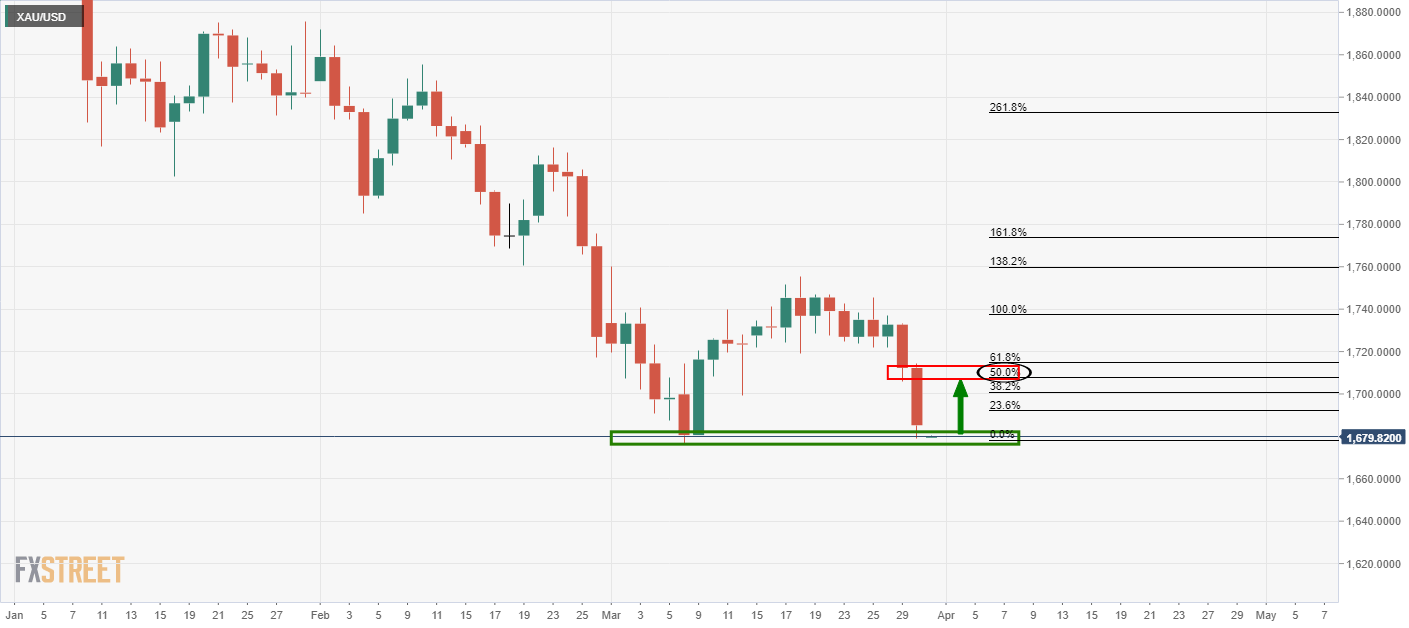

The latest bearish impulse has seen a correction to the 61.8% Fibonacci and beyond, although there are prospects of a downside extension at this juncture on a break of $1,717.

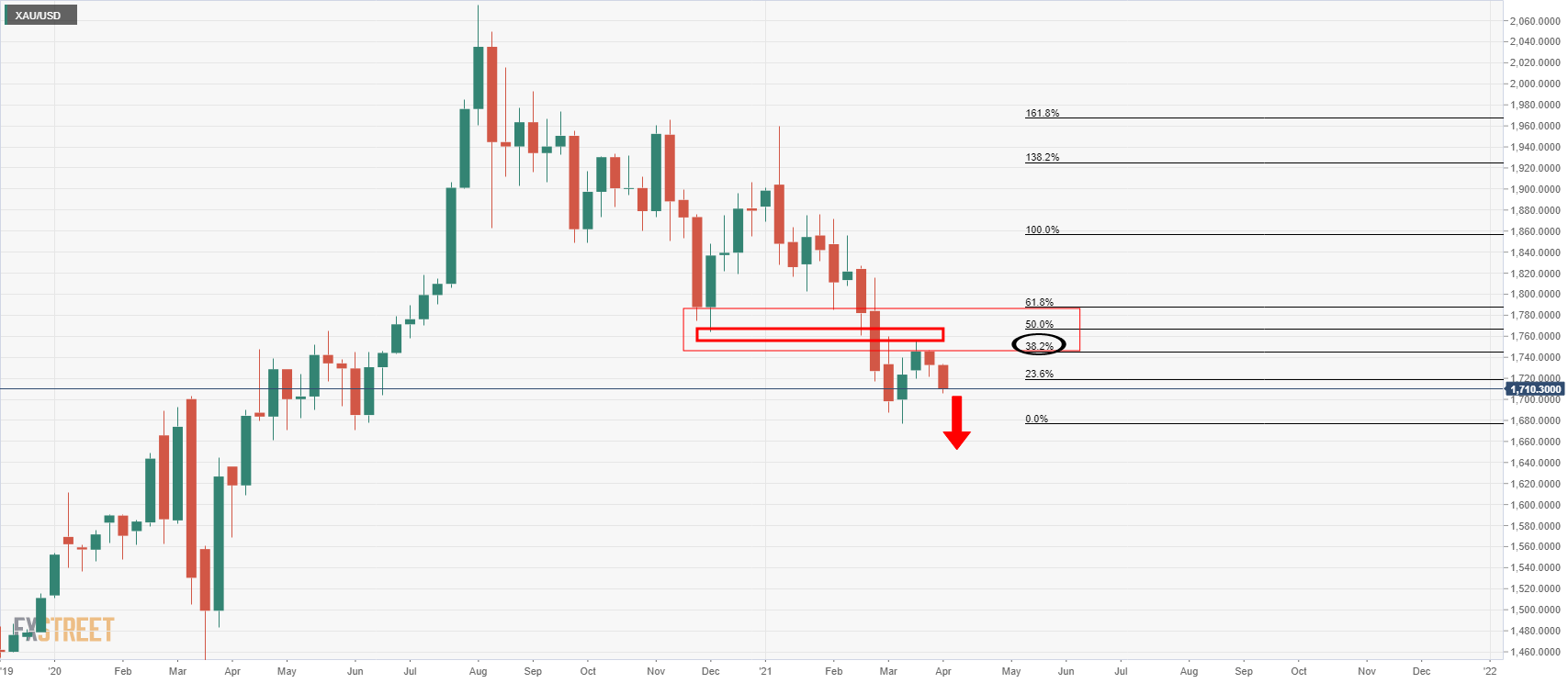

Prior analysis, weekly

The weekly outlook is bearish in that the market has corrected the bearish impulse in a significant Fibonacci retracement which would now be expected to see a continuation to the downside.

Live market, daily & weekly

However, a 50% mean reversion from support could be on the cards at this juncture, especially if traders need to sell-back dollars to square their books for the quarter-end.