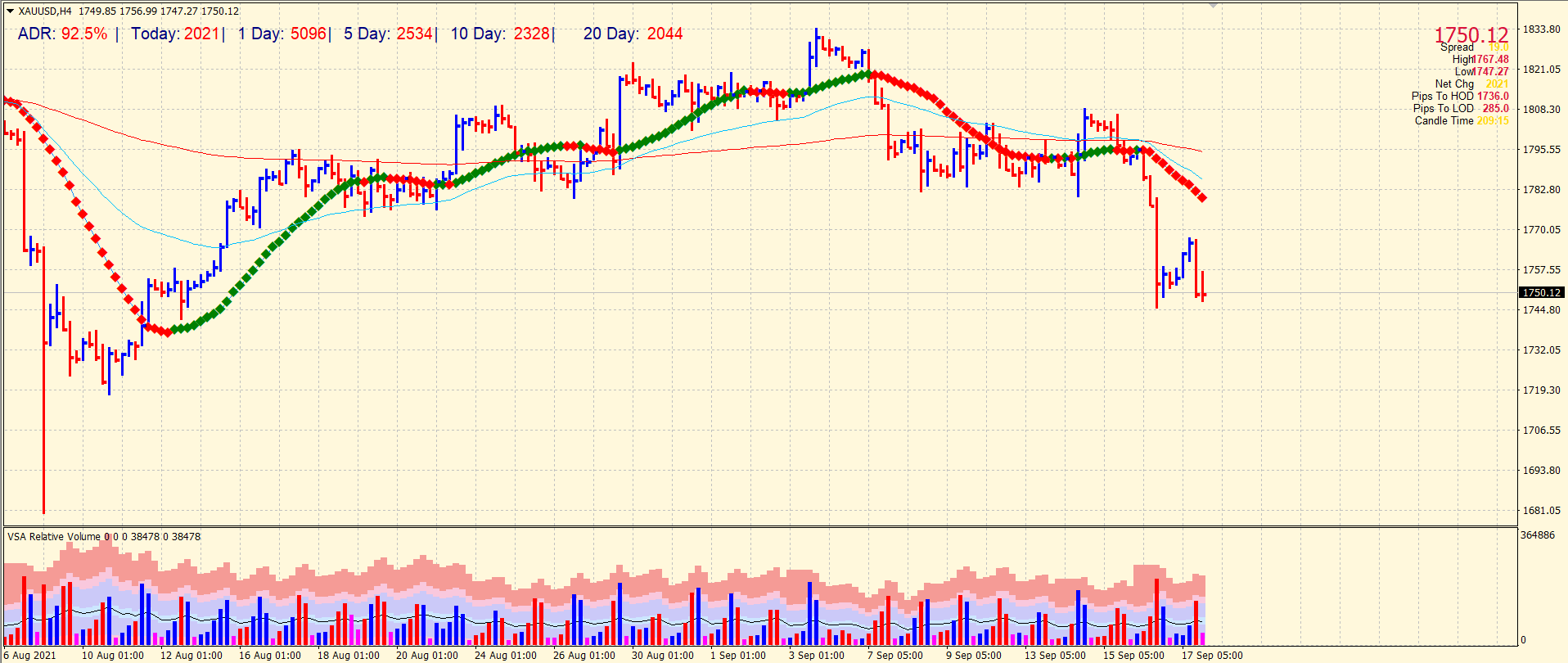

- Gold price trades near the bottom range, around $1750.

- Upbeat US retail sales boost the Greenback.

- Rising US 10-year yields lend decent support to the dollar.

The gold price outlook is bearish as the price slumps after the US dollar picked momentum from upbeat retails sales data.

-Are you looking for the best CFD broker? Check our detailed guide-

The price of gold struggled to hold its intraday gains and fell to the lower end of the daily trading range at the start of the North American session. A moderate pullback in the US dollar following Thursday’s three-week highs was seen as a key factor supporting the dollar-denominated commodity.

Nonetheless, the dollar benefitted from rumors that the Fed may tighten earlier. Consequently, the non-yielding yellow metal’s growth slowed, but new sales of 1,767-68 US dollars ensued.

On Thursday, consumer confidence was bolstered by strong US retail sales, indicating that the economy is continuing to recover. Fed incentives for pandemic preparedness are expected to be phased out later this year, investors say.

A fresh rise in yields on US Treasury bonds also supported the dollar. A ten-year Treasury bond yield set a record of 1.35%. Thus, the FOMC’s September 20-21 monetary policy meeting will be the next big event for gold.

In addition, rising expectations of an imminent Fed cut announcement and ongoing concerns over the delta variant contributed to a drop in sentiment. As a result, stock markets have taken a cautious stance.

At least for the time being, this may be the only factor that helps limit serious losses in bullion gold. The Michigan Consumer Sentiment Index slightly missed expectations arriving at 71.0 against the expected 71.9. The market remains unmoved.

-Are you looking for forex robots? Check our detailed guide-

Gold price technical outlook:

Gold price is wobbling around $1750 area and may test the recent swing lows around $1744. The 4-hour chart shows a strong consolidation near the lows. The volume supports bearish momentum, while the average daily range is 92%. Hence, the market seems almost done for the week. We may find some trading opportunities on Monday.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.