- While WTI is trading rather weakly, it remains well supported above $73.00 after falling to $72.20.

- Despite this week’s recovery from lows of $66, the oil price is likely to remain sharp in the headlines.

- Omicron news will remain the main driver of risk appetite.

WTI prices were quite low on Thursday, with deteriorating liquidity over the holidays. For the coming month, futures for crude oil are currently trading just above $73 and are struggling to break through the $73.25 highs set during trading in the Asia-Pacific region.

–Are you interested to learn more about STP brokers? Check our detailed guide-

These prices were just below the 9-month high of $73.30 set in December. According to the recent price movement, markets are generally bullish, with an earlier drop to $72.20 being bought.

Amid the ever-changing global situation with Omicron, the break on Thursday marks the delayed arrival of the typical break before Christmas/New Year. From Monday’s lows, oil prices have recovered remarkably this week, with WTI crude rising nearly $7.0 from a low of around $66 per barrel.

Successive studies in South Africa, Scotland, and London have shown that Omicron is associated with a significant reduction in hospitalizations due to the new opportunity. Therefore, governments are less likely to impose economically damaging / limiting restrictions on fuel demand.

Strong US data also contributed to the risk regime in the market, which has lifted oil recently. Therefore, attention will be focused on Thursday’s 1330 GMT and 1500 GMT US macroeconomic releases.

According to EIA data released Wednesday, supporting price is also a much larger-than-expected increase in US crude oil inventories. However, Omicron news will remain the main driver of risk appetite, and although volumes are forecast to fall as the session progresses, oil prices will likely continue to dominate headlines.

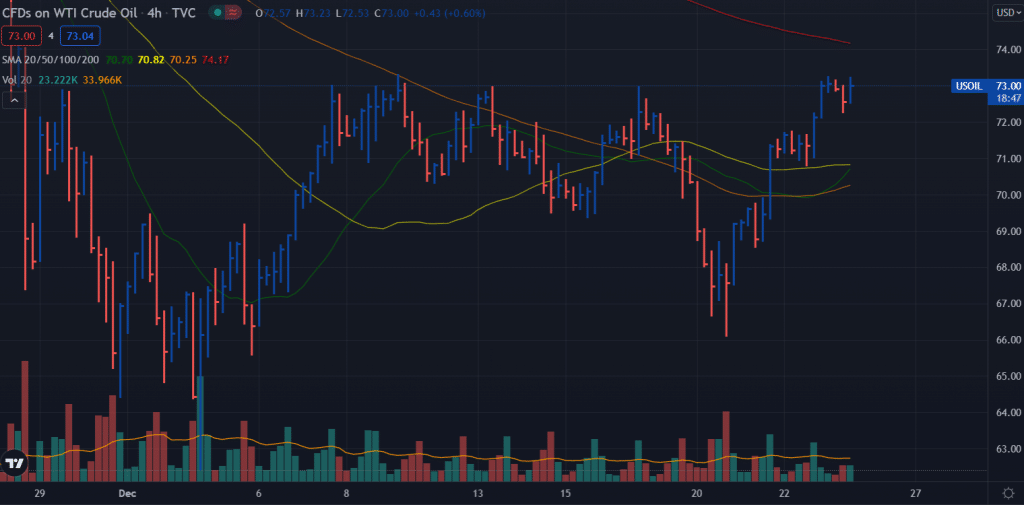

WTI price technical analysis: On the verge of resistance

The WTI price is wobbling above the key SMAs on the 4-hour chart. However, the price is still below the 200-period SMA at $74.0. The price is expected to stay choppy, around $72 – 74.

–Are you interested to learn more about Forex apps? Check our detailed guide-

The bias is bullish, but the price is standing at the stiff resistance level, and the probability of falling towards the SMA cluster around $70.0 still exists.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.