- The bias remains bearish despite temporary rebounds.

- The 1.0000 psychological level stands for static resistance.

- The FOMC and NFP could be decisive during the week.

The EUR/USD price dropped after failing to reach the 1.0100 psychological level as the US dollar rebounded. The bias for the pair remains bearish despite temporary rebounds.

-Are you looking for automated trading? Check our detailed guide-

After its strong downside movement, the price returned to retest the key levels before going down. The currency pair started to drop after the ECB. As expected, the Main Refinancing Rate was increased from 1.25% to 2.00%.

The ECB’s President announced further rate hikes in the upcoming meetings. Fundamentally, the Eurozone and the US data came in mixed on Friday.

Today, German Retail Sales may report a 0.5% drop, while the Italian Prelim GDP is expected to drop by 0.1%. In addition, the Eurozone CPI Flash Estimate could report a 9.9% growth, Core CPI Flash Estimate is expected to register a 4.8% growth, while Prelim Flash GDP may report a 0.1% growth.

On the other hand, the US is to release the Chicago PMI, which could jump from 45.7 points to 47.8 points, and the Loan Officer Survey. The fundamentals will drive the price during the week. The FOMC on Wednesday and the Non-Farm Payrolls on Friday could be decisive.

In addition, the US is to release the ISM Manufacturing PMI, JOLTS Job Openings, ADP Non-Farm Employment Change, ISM Services PMI, Unemployment Rate, and the Average Hourly Earnings.

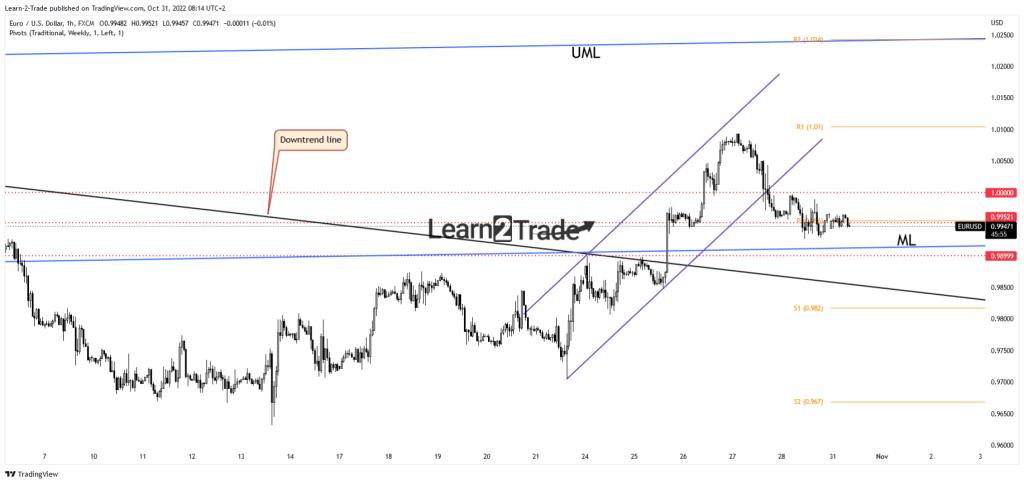

EUR/USD price technical analysis: Prevailing downside pressure

The EUR/USD pair dropped below the 1.0000 psychological level after failing to stay above the channel’s support. Now, it moves somehow sideways. The weekly pivot point of 0.9960 stands as an upside obstacle.

-If you are interested in forex day trading then have a read of our guide to getting started-

The ascending pitchfork’s median line (ML) represents dynamic support. The price could still develop a new bullish momentum as long as it stays above. This scenario could take shape if the US dollar falls again. Dropping and stabilizing under the median line confirm strong sellers and a potential deeper drop. Still, a larger downside movement could be activated only after dropping below the down trendline. On the contrary, returning above parity may announce strong upside pressure and open the door for more gains.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.