Two decisions regarding Greece are awaited. Greek CDS is not triggered, at least for now. This isn’t the last call.

The second question relates to the approval of the Greek bailout. Also here, it seems that leaders will wait. The clock doesn’t wait, and EUR/USD tests lower support in the meantime.

ISDA, the organization that decides whether credit events are triggered or not, was asked a simple question: does the fact that the ECB will get all the money on its Greek bonds and the rest won’t, mean that the there was a material breach of the bond contract?

The straight answer is YES. Nevertheless, the answer of ISDA was a a unanimous NO. Well, no payment was denied. Not yet. The results of the bond swap are still awaited.

ISDA did leave the door open to changes, when “new things come to light”. This could be soon. So, no credit event for now.

Finance Ministers Meeting

Greece passed fresh laws earlier in the day, regarding reforms in the health sector. This is part of the “prior actions” demanded in the February 21 agreement on a bailout.

According to Greece, it complied and should get the final approval for the funds. According to the Dutch finance minister Jan Kees de Jager, this isn’t certain.

He said that a decision isn’t likely today. Greece is awaiting its verdict.

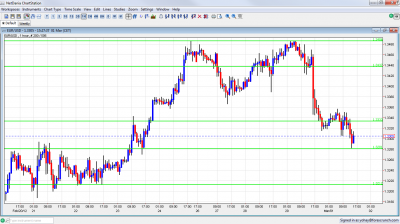

EUR/USD doesn’t wait and continued slipping lower. It fell and bounced off the 1.3280 line before recovering and climbing over 1.33.

1.3333 was a battle line that the pair reached yesterday. Further support is at 1.3212. See more lines in the euro to dollar forecast.

The clock is ticking towards March 20th, when Greece needs to pay back over 14 billion euros of bonds. It has 7 days of grace until March 27th.

Friday, March 23rd, still looks like the optimal time for an announcement of a Greek bankruptcy.