Euro dollar didn’t do much yesterday (March 28th) and was traded slightly up by 0.01%. Yesterday many other currencies depreciated against the USD including the AUD and CAD. The U.S durable goods report continued to show growth but missed the expectations of many analysts. The Bernanke bump, following the Chairman of the Fed speech earlier this week about the labor market, seems to have dissipated. The EU ministers of finance will decide today on the expansion of the rescue fund to €1 trillion. Will this move calm the financial markets? It’s not clear yet. Today there are several news items on the agenda including US jobless claims weekly update and U.S GDP final estimate.

Here’s an update on fundamentals and what’s going on in the markets.

EUR/USD Fundamentals

- 08:55 German Unemployment Change

- 13:30 U.S GDP final estimate

- 13:30 U.S Jobless claims

- 23:45 FOMC Member Lacker Speaks

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- EU Ministers of Finance may Decide to expand Rescue Fund : EU ministers of finance may deicide to raised for one year the rescue aid ceiling to €1 trillion (roughly $1.3 trillion). This is an attempt to ease the concerns in the financial markets and also keep the debt crisis contained..

- Spain will have a general strike today: This one day strike throughout Spain is a protest to the new austerity measures the new government will try to introduce tomorrow March 30th .

- U.S Durable Goods Increased again in February: According to the recent report, during February 2012, new orders of manufactured durable goods increased by $4.5 billion or 2.2% to $211.8 billion; Shipments of manufactured durable goods on the other hand decreased by $0.8 billion or 0.4% to $206.6 billion. Shipments of manufactured increased in the past couple of months.

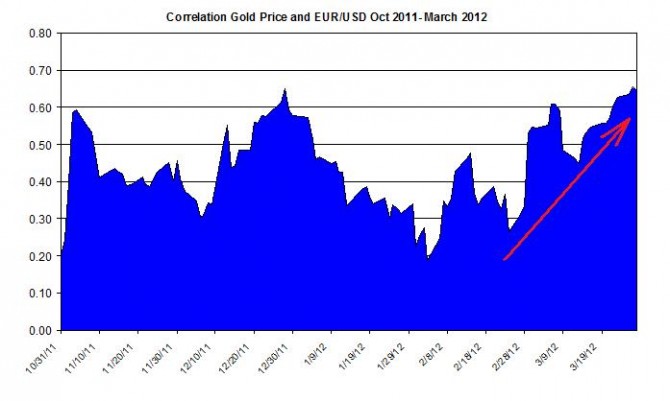

- High correlation between Euro/USD and gold price: Despite the fall of gold price and the rally of the Euro/USD in recent weeks their linear correlation is getting stronger. Their current linear correlation stands on 0.64 (see chart below). This finding suggests the relation between the Euro/USD and gold price continues to be strong and robust and any movement in the Euro/USD will likely to affect the direction of gold price.