When the ECB introduced its huge stimulus package in March, President Draghi accompanied the announcement with a statement basically saying they are done for now. Those words reversed the fall of EUR/USD and actually sent it to higher ground.

Within the meeting minutes from that decision, we can see that the ECB still has room to cut. They had discussed a sharper rate cut but decided that such a deeper cut would take the ECB to its lower bound.

In the past, the ECB has already said rates have reached their lower bound, only to further cut them. The statement from September 2014 (when the deposit rate stood at -0.20%) held on until December 2015 (when it was cut to -0.30%.

Another cut to -0.40% in March 2016 was accompanied by a declaration that it is enough for now, but only 4 weeks later, we learn today that the lower bound is actually lower than the current level and that such a move was discussed.

With meeting minutes, it is always important to remember that there is a reason why it takes time to publish them: the members are well aware of market implications and the document is modified to send a message.

The message here is clear: more rate cuts are on the cards.

And that’s different from Draghi’s statement. The president of the ECB will speak later in the day. His colleague Peter Praet has already said that policy could be further “calibrated”. Praet is a known dove and not the man at the helm. Will we hear similar tunes from Draghi?

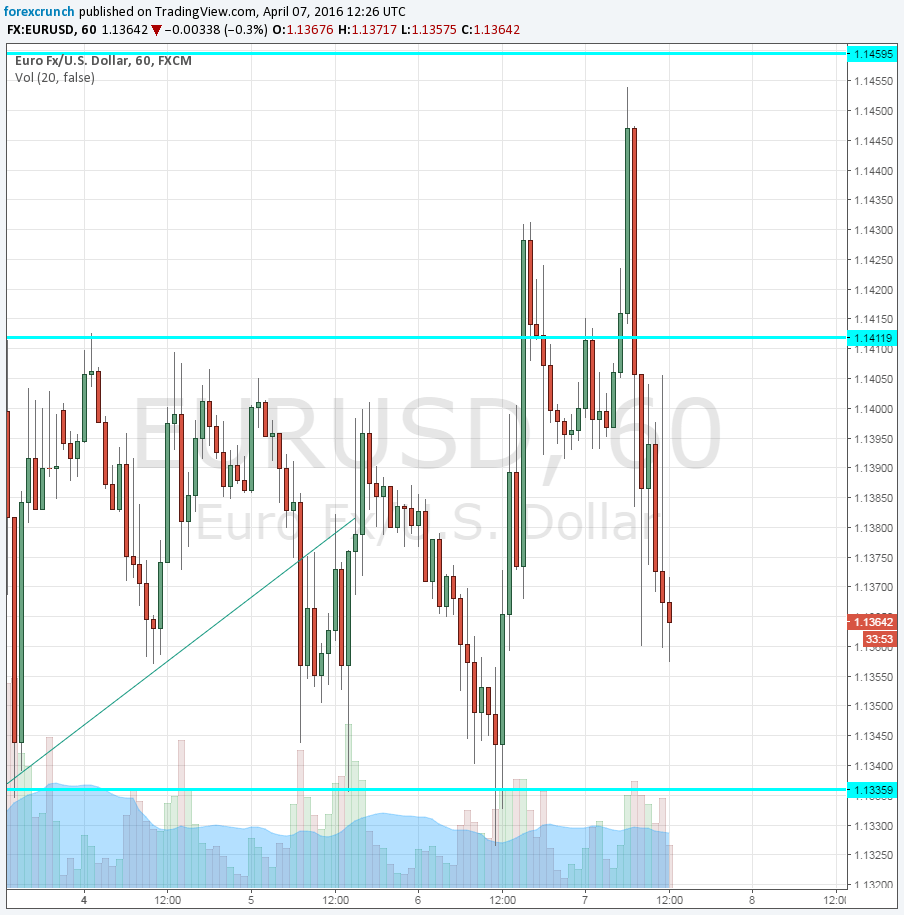

At the moment, EUR/USD is losing some ground from the highs. It bounced at critical resistance just under 1.1460 and is trading at 1.1364, around 100 pips below this level, and well within the previous range. The dollar does not look too weak at the moment, and what stands out now is only yen strength.