Dollar/yen made quite a turnaround, mostly as a reaction to the NFP and after having reached new lows. Is it only a correction or a bit more than that? And why is the yen losing ground when markets are falling this way?

USD/JPY fundamental movers

Farewell Yellen, a rise in wages

Yellen’s last rate decision was relatively quiet, but it also consisted of subtle hawkish shifts. These helped the US dollar in its attempts to recover and more importantly, laid the ground for the turnaround.

The Non-Farm Payrolls report was good on the headline and excellent on wages. A more sustained rise in salaries could be seen, and this could pave the way for more rate hikes from the Fed.

The rise of the dollar was accompanied by a fall in stock markets: higher rates should be bad for stocks. And in such a “risk-off” sentiment, one would expect the yen to thrive. However, this did not happen.

ISM services, Dudley, and politics

The week begins with a noteworthy US figure: the ISM Non-Manufacturing PMI. Wednesday sees an important speech from Bill Dudley, the outgoing President of the New York Fed and then it’s only politics: the Russia investigation returns to the headlines. Will it impact markets this time?

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

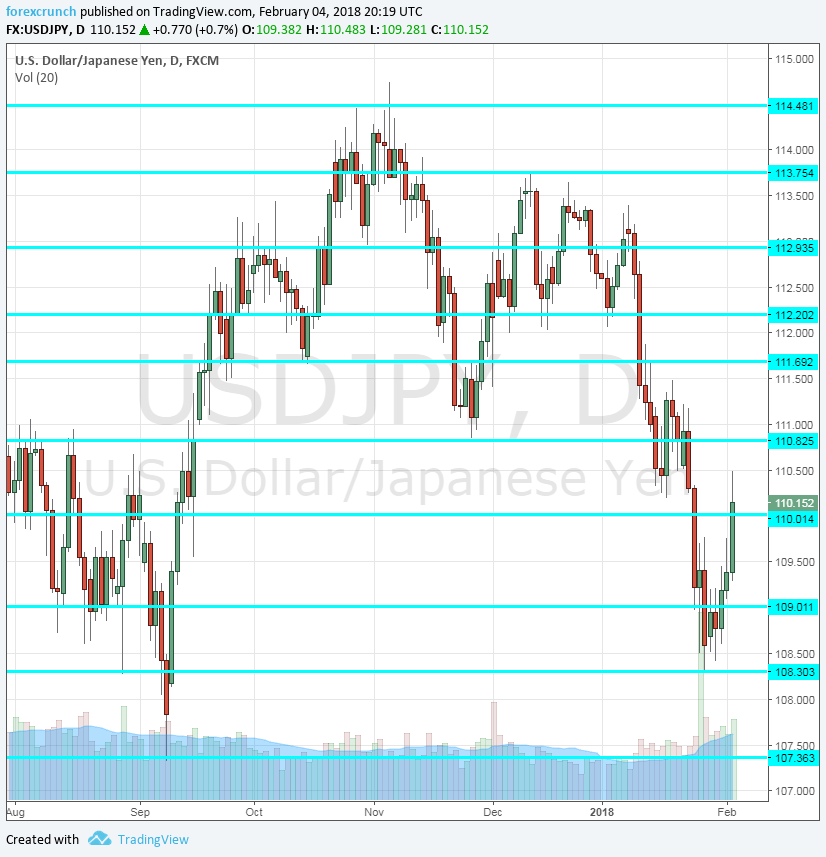

114.50 remains the top line of the range despite a quick breach in the autumn. It is followed by the high of 113.75.

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.10 as the ultimate level.

If the pair falls even lower, the round number of 105 will come into play, followed by 103.30.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

The excellent US Non-Farm Payrolls is clearly positive for the greenback and is not fully priced in. However, if stocks continue falling, it is hard to see the yen staying behind.

Our latest podcast is titled When everything sells off, where is the money going to?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!