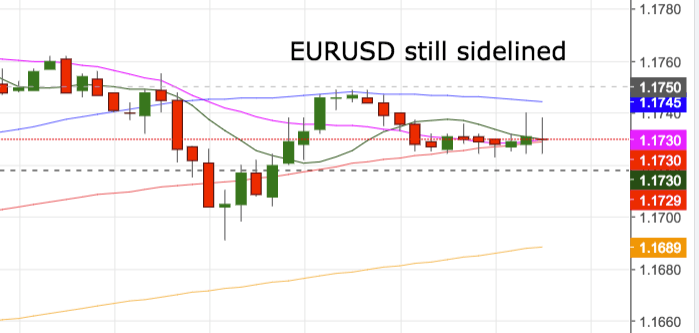

- Spot recovered from the knee-jerk to the 1.1690 region on Tuesday and returned to the 1.1720 region, where sits the 23.6% Fibo retracement of the April-May drop.

- While above the 10-day SMA (1.1686) and the 21-day SMA (1.1656), another visit to recent tops in the 1.1800 first and then an attempt to the critical hurdle in the mid-1.1800s is not ruled out.

- However, failing to test the vicinity of the 1.1800 handle in the near term should open the door for a consolidation phase and further loss of upside momentum.

- In this scenario, the 1.1530 region should be back on the radar ahead of 2018 lows in the 1.1500 neighbourhood.

Daily high: 1.1747

Daily low: 1.1723

Support Levels

S1: 1.1702

S2: 1.1660

S3: 1.1630

Resistance Levels

R1: 1.1775

R2: 1.1805

R3: 1.1848