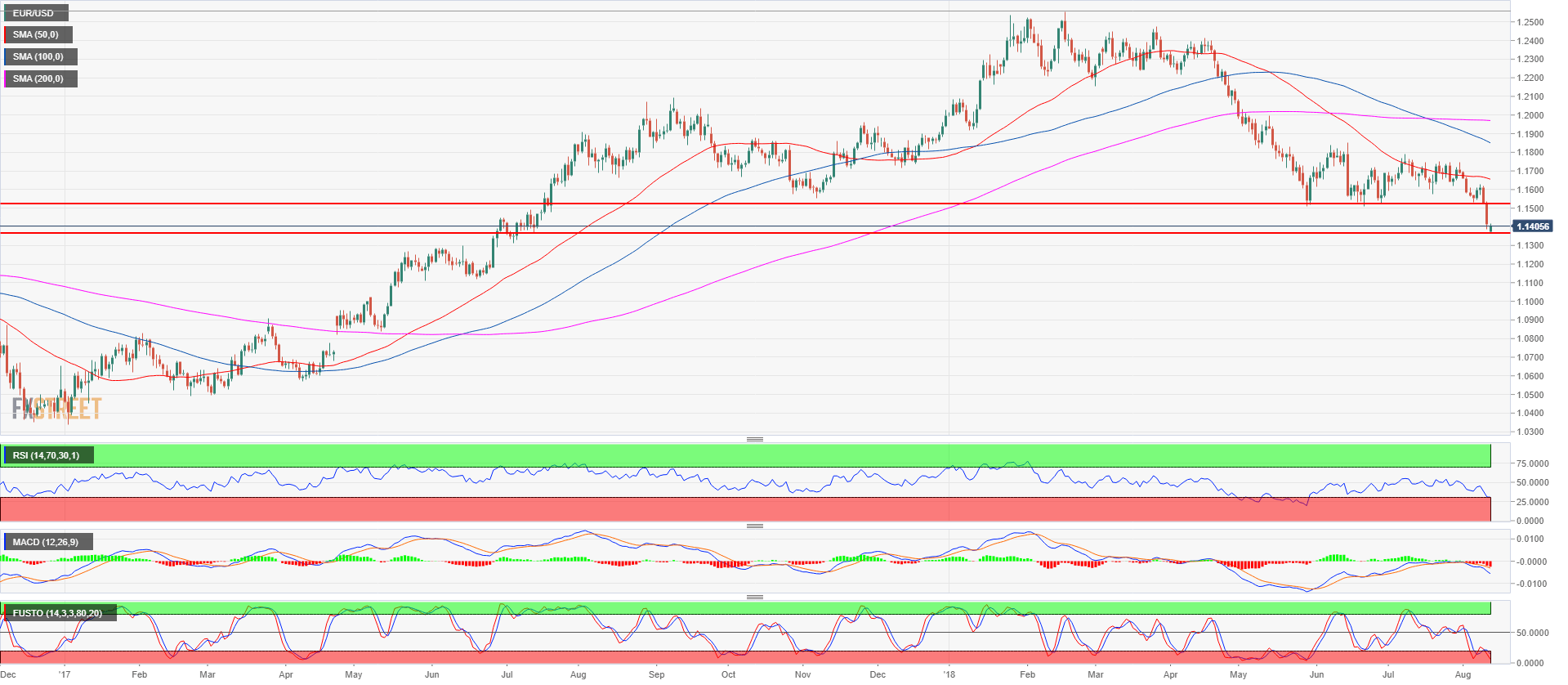

- EUR/USD fell to a 13-month low this Monday at 1.3650. The market is currently finding short-term support at the 1.1370 level, the July 13, 2017 low.

- EUR/USD bears objective is to keep extending the bear trend below the current 2018 low towards the 1.1300 figure.

- On the flip side, bulls will try to keep the market supported above 1.3650 in order to reach 1.1432 and 1.1483 intraday swing high. Bulls currently have a slight advantage in the short-term above 1.3650.

EUR/USD 15-minute chart

EUR/USD daily chart

Spot rate: 1.1406

Relative change: -0.04%

High: 1.1415

Low: 1.1365

Trend: Bearish

Resistance 1 1.1432 Intraday swing low

Resistance 2: 1.1483 intraday swing high

Resistance 3: 1.1508 June 8 low

Resistance 4: 1.1527 June 28 low

Resistance 5: 1.1571-1.1581 area, August 6 high and August 2 low

Resistance 6: 1.1600-1.1620 area, figure and July 27 low

Resistance 7: 1.1640-1.1649 area, key level and July 12 low

Resistance 8: 1.1672 June 27 high

Resistance 9: 1.1700 figure

Resistance 10: 1.1750 supply level

Resistance 11: 1.1760-1.1795 supply levels

Resistance 12: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1370 July 13, 2017 low

Support 2: 1.1300 figure

Support 3: 1.1178 June 27, 2017 low