GBP/USD was pressured on fears of a no-deal Brexit and was unable to take full advantage of the gradual retreat of the US Dollar. What’s next? Here are the key events and an updated technical analysis for GBP/USD.

The EU and the UK have agreed to hold non-stop Brexit talks. The news initially helped the pound recover. However, there has been no breakthrough in the talks and the UK government published papers to prepare the public for a no-deal Brexit. In the US, Trump sent the dollar lower with his legal trouble and also by complaining about the Fed’s rate hikes. Nevertheless, the FOMC Meeting Minutes conveyed an upbeat message.

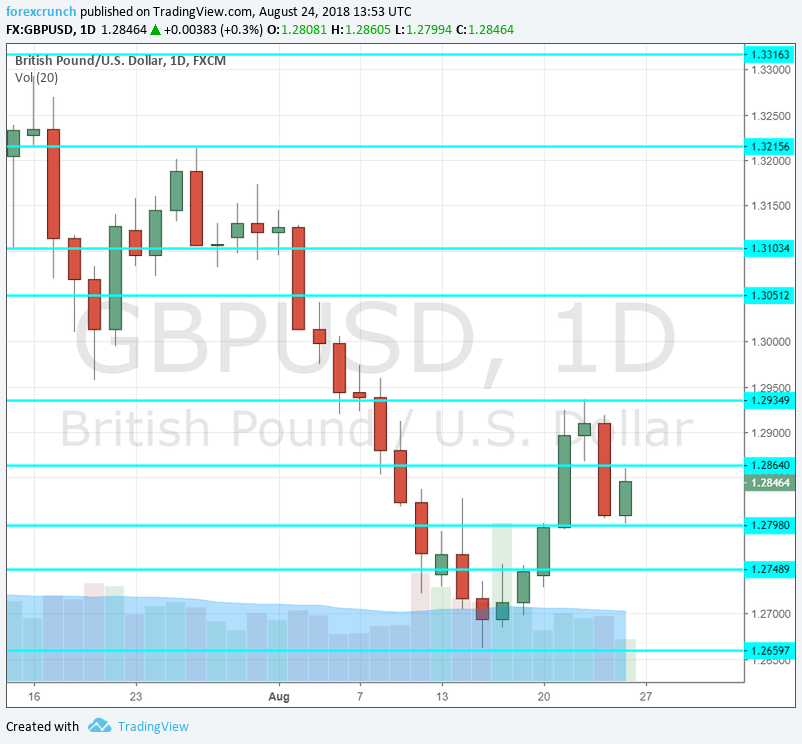

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s inflation gauge showed a drop of 0.3% y/y in prices back in July, a slower slide than beforehand. The change in prices may be limited now.

- M4 Money Supply: Thursday, 8:30. The amount of money in circulation dropped by 0.3% in June, below expectations. It will be interesting to see if the recent BOE rate hike will have another detrimental impact on the velocity of money.

- Mortgage Approvals: Thursday, 8:30. The official measure of mortgages lags behind the High Street Lending gauge. Nevertheless, it provides a broad overview of the housing market. Mortgages rose to a level of 66K in June. A similar number is likely now.

- Net Lending to Individuals: Thursday, 8:30. Lending to individuals rose to a net value of 5.4 billion in June, yet within well-known ranges. No big changes are likely now.

- GfK Consumer Confidence: Thursday, 23:01. This broad survey of 2,000 consumers disappointed with a drop to -10 points in July, reflecting growing pessimism, some of it Brexit related. No significant improvement is likely now.

- Nationwide HPI: Friday, 6:00. This is one of the earliest house price figures in the UK. Back in July, it surprised with a second substantial rise of 0.6%, better than had been expected. A rise of 0.1% is on the cards now.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar initially advanced but fell short of challenging 1.3000.

Technical lines from top to bottom:

1.3215 was the high point for the pair in mid-July and a lower high on the chart.

1.3100 was a swing low in mid-June and 1.3050 was a previous 2018 low.

Below 1.3000 we find 1.2935, a high point in late August. 1.2865 separated ranges in late August. Further down, 1.2790 served as support late August and also beforehand.

1.2750 held the pair down when the pair was on the back foot. The current 2018 trough at 1.2660 is the next level.

1.2590 was a swing low in September 2017. Even lower, 1.25 is a round number and also worked as support in early 2017.

I remain bearish on GBP/USD

Brexit is biting and the negotations are not going anywhere fast. Alongside Trump’s trade wars, there is more room to the downside than to the downside.

Our latest podcast is titled Brexit summer blues, trade troubles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!