The “Day of Reckoning” for the global economy is nigh, says RBS, and the weak USD just postpones it. What’s next? Here is their view:

Here is their view, courtesy of eFXnews:

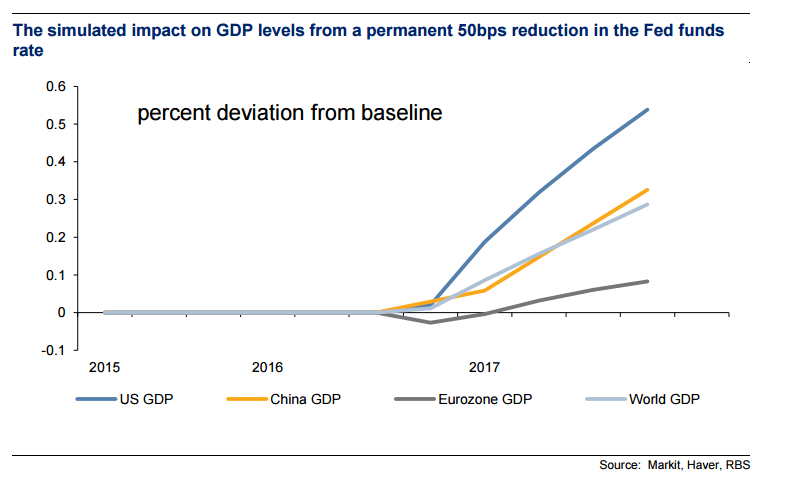

The Fed’s shift toward a more growth-friendly stance ought to be helpful in mitigating the downside risks to the world economy in the near-term. We had previously articulated that there was a more than a one-in-two chance of a global recession in the period immediately ahead. But via an unexpected Fed-induced loosening of financial market conditions that probability has fallen appreciably.

Keeping recession risks under wraps, however, will require ongoing Fed accommodation and a weak US dollar. Indeed in the absence of bolder reforms and greater fiscal activism a weak US dollar is one of the only valves that can be opened right now to alleviate underlying global financial tensions. The paradox, however, is that those tensions are a by-product of too much global debt but they are being alleviated by incentivising further debt accumulation.

This dollar valve moreover can only be left open without duress as long as the Fed’s credibility remains intact. And that will clearly hinge on whether or not the US labour market can continue to tighten without generating meaningful wage pressures. Any sign that the US labour market is tightening more rapidly than expected would clearly erode that credibility and impair financial instability via its impact on US profits, monetary policy settings and the US dollar.

A day of reckoning for the world economy in other words has been postponed but it has not yet been averted.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.