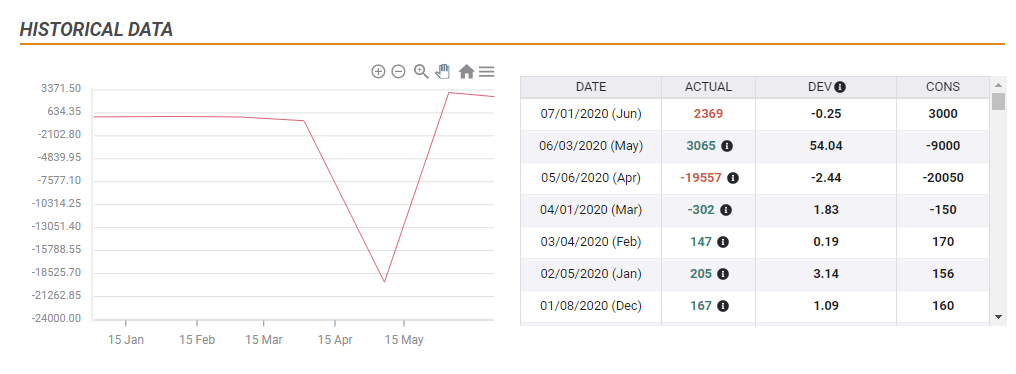

- ADP reported an increase of 2.369 million private-sector jobs in June, below expectations.

- Even after the whopping upward revision for May, job losses are devastating.

- After staging the best quarter since 1998, another S&P seems unreasonable.

When an increase of over two million jobs – and an upward revision worth nearly six million – are shrugged off by markets, there is a greater issue. ADP, America’s largest payroll provider, reported an increase of 2.369 million private-sector positions in the US in June. Expectations were closer to three million, so the actual number missed expectations.

ADP also revised its figures for April, moving from a loss of 2.76 million to an increase of 3.065 million – an astonishing change of six million. However, with this modification, the software firm aligns itself with the official Non-Farm Payrolls figures for May – and increase of 2.509 million jobs.

Ahead of the Bureau of Labor Statistics NFP report for June – coming out on Thursday for a change – can investors cheer? The total job gains are above eight million.

However, they do not compensate for 19.409 million positions lost in April and another 300,000 or so in March. The bounce from the lows is far from a V-shaped recovery.

Overall, ADP reported over 14 million jobs due to coronavirus.

Bounce, not a recovery

The bigger question is – will the US labor market continue its upward trajectory and complete a full recovery in the upcoming months? The answer is unfortunately negative.

Employers do not hire so many workers in two months – these are furloughed or laid-off workers who have returned to their positions. The rapid bounce may be close to an end – with fewer “long-hanging fruits” left.

Moreover, ADP surveys were taken in the week including June 12 – and things have changed since then. Coronavirus cases have been surging in the latter half of the month, first causing people to voluntarily stay at home – and later to trigger such official orders or halt the reopening. That has happened in many states, from California to Florida.

Services producing jobs have added 1.9 million according to ADP and many of them are in the leisure and hospitality sectors. Some of these positions may be lost amid the second wave.

Overall, the current figures are unlikely to be the high watermark of the bounce – but this is most probably only a bounce – not a recovery, especially not a V-shaped one.

S&P 500 implications

The S&P 500 Index enjoyed a robust recovery in the second quarter – the best since 1998. The gains have been fueled by the Federal Reserve’s $3 trillion increase in its balance sheet and also some hope for a recovery. That may already be in the price after that impressive Q2 – and could have already reached unsustainable levels.

Will stocks fall now? That may have to wait for the official Non-Farm Payrolls, or perhaps later on when data from the latter half of June comes out.