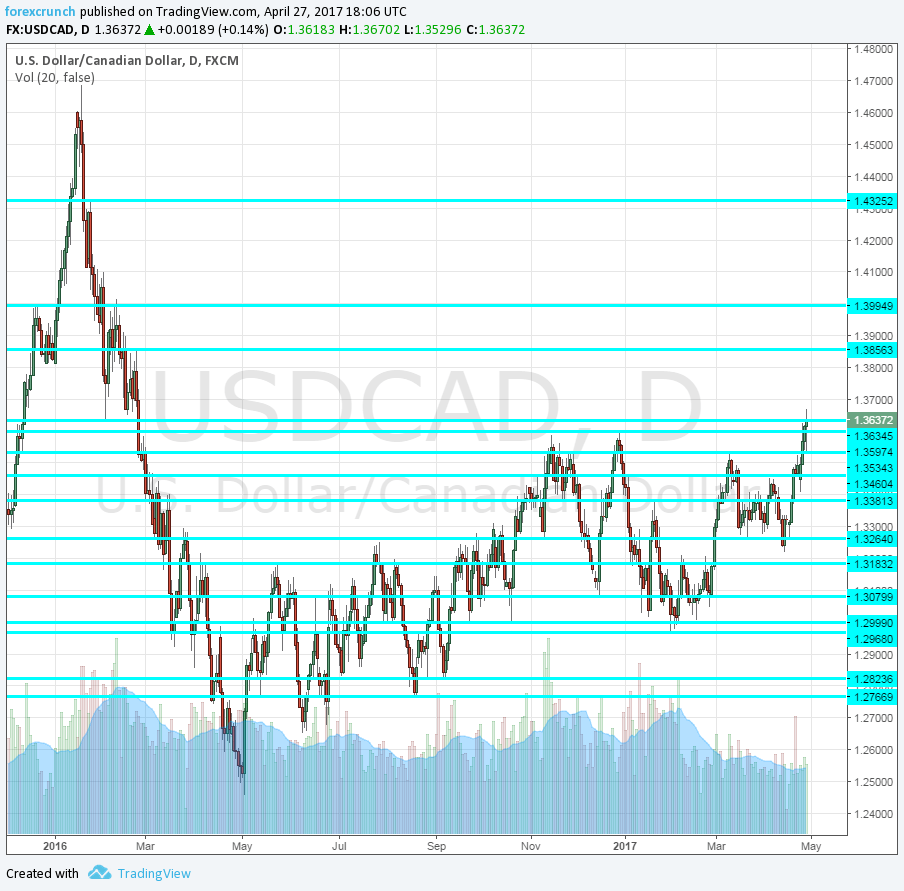

The Canadian dollar remains under pressure. The pair reached a new high at 1.3670, reaching yet another 14-month high. The next level of resistance is only at 1.3850.

The last time the pair saw these levels was in the wake of 2016. The crash in oil prices sent Dollar/CAD shooting all the way to 1.4690. Yet the fall was as quick as the rise. In a matter of months, the pair jumped from ranges seen recently to these sky-high levels before crashing to much lower one, at the 1.24 handle.

Will we see this again? The roller-coaster is unlikely to return, yet a gradual climb to higher ground is on the cards.

USDCAD pressured not only by oil

The black gold is the easy culprit for the drop in the value of the loonie. WTI Crude Oil slipped under $49 per barrel. It just cannot hold onto the $50 level for a long time. A break above $55 seems hard to pull off.

While OPEC and its non-OPEC associates may extend the production cut, this may spur another rise in US shale production which continues its steady rise.

Another ongoing issue for the Canadian dollar stems from house prices in Canada’s top cities. After the government of British Columbia introduced measures to curb the steaming hot market in Vancouver, the regional government of Ontario followed suit. They worry about house prices in Toronto and its surroundings.

Is this the end of the bubble? Markets can remain insane longer than participants remain solvent, said Keynes. Yet reports about issues with Canadian lenders as well as developers start appearing.

And the recent rally in USD/CAD originates from Trump’s fresh focus on trade with its northern neighbor. The US president and Canadian PM Trudeau started their relationship on strong footing, with a warm meeting at the White House.

Things deteriorated in recent days with complaints about Canadian politicians outsmarting American ones on issues ranging from the dairy in Wisconsin through lumber, timber, and softwood. Trump’s threat to tax timber triggered the initial CAD tumble.

Reports on totally abandoning NAFTA circulated in Washington and were later denied by the White House. At the moment, the official US position is that the US just wants to renegotiate the deal rather than abolish it. Mexico and Canada are open to talks, but the damage has already been done.

More: USD/CAD: Is this just the beginning? 1.40 is next?

Here is how the recent moves look on the Dollar/CAD daily chart: