EUR/USD has been stuck in a range for quite some time, frustrating many traders. The team at Bank of America Merrill Lynch analyzes the frustration and assesses what’s next:

Here is their view, courtesy of eFXnews:

Another frustrating year for EUR bears

Our year-ahead outlook for the Euro had warned of more frustration for EUR/USD bears and this has indeed been the case so far. For the rest of the year, EUR/USD is mostly a Fed call, in our view, as markets have already priced ECB QE extension. We expect the Fed to hike again in December, which may push EUR/USD lower by year-end. However, that may be the time to buy the Euro again.

Data suggests mixed EUR/USD outlook

Data suggests a mixed outlook for EUR/USD, which was also the case earlier this year. Data that has to do with the state of the recovery and inflation would justify a weaker EUR/USD. Data that has to do with the momentum of the economy would justify a stronger EUR/USD.

EUR/USD positioning suggests balanced risks

Our positioning analysis suggests that speculators are vulnerable to a positioning squeeze if EUR appreciates, while real money is vulnerable to a positioning squeeze if EUR weakens.

The ECB is becoming a positive risk for the Euro

We argue that the ECB is reaching self-imposed constraints that could affect its credibility with markets. The next QE extension requires only tweaks to the current QE program. However, we are concerned about ECB market challenges next year, similar to those the BoJ has been facing this year, when QE extension will require more fundamental changes to the program. Markets could challenge the sustainability of the ECB policies, leading to a stronger Euro in 2017, despite diverging monetary policies.

A strong Euro can coincide with a periphery sell-off

The periphery problems remain, but markets have become immune to them because of the ECB’s QE. We believe the periphery could lose the ground under its feet if the market starts pricing the end of the ECB’s QE. A periphery sell-off in this case would be consistent with a stronger Euro, both driven by the same force.

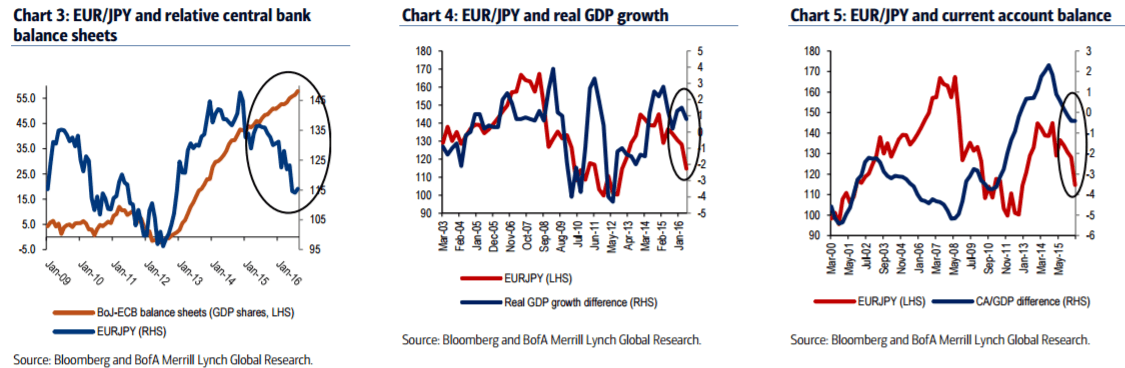

We are bullish EUR/JPY medium term

Although in the short-term the Euro will likely depend mostly on the Fed, in the medium term we are bullish EUR/JPY. The BoJ has partly addressed its recent challenges by increasing the flexibility and improving the sustainability of their policy framework. However, it is now the ECB’s turn to relax its QE constraints, which may prove to be even more difficult than for the BoJ. Fewer challenges for the BoJ and more challenges for the ECB should be positive for EUR/JPY, in our view. Relative ECB and BoJ balance sheet expansion and relative data both point to a much stronger EUR/JPY (Chart 3), Chart 4 and Chart 5). We project EUR/JPY to appreciate to 127 by the end of 2017, with risks to the upside, although we note the US elections will be an important component to monitor in the short term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.