The Australian dollar was cheered by China but that didn’t last too long. Where next?

Here is their view, courtesy of eFXnews:

Markets are moving ahead of the AUD, such that January’s currency decline does little to realign valuation, notes Australia and New Zealand Banking Group (ANZ).

“Fundamental drivers may become less supportive at the margin as expectations adapt to recent positive data surprises and iron ore resumes its decline.

Sustained weakness in broader markets and the continued running down of global currency reserves will keep the AUD on the back foot,” ANZ argues.

SO ALL ROADS LEAD TO MORE DOWNSIDE RISK:

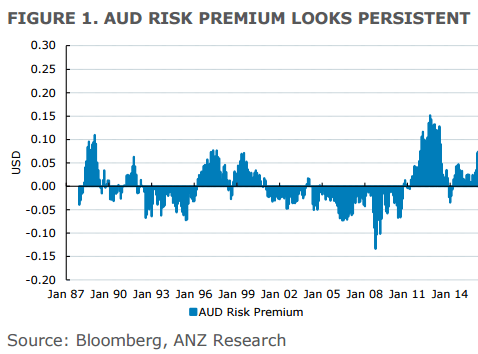

“In a market where volatility remains heightened, policy uncertainty elevated, and liquidity continues to tighten via declining reserves, the AUD should continue to decline, and as in previous occasions the AUD should trade at a discount to other risky assets. (ie The AUD should have a negative premium in our model). This is something that we have not yet seen this cycle,” ANZ adds.

ANZ targets AUD/USD at 0.67 by end of Q1 and at 0.64 by end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.