An exciting first quarter is now behind us. As the second one begins, here are two observations on the charts.

What’s next for AUD and EUR? The team at Bank of America Merrill Lunch weighs in:

Here is their view, courtesy of eFXnews:

Contrary to expectations, AUD/USD has broken sharply below the 50d MA and risks new cycle lows, notes Bank of America Merrill Lynch.

However, BofA argues that evidence continues to indicate a very late stage decline.

“Weakness should be limited to 0.7467 channel support, worst case 0.7360/0.7214 (6m downside slopping channel in brown and 14yr trendline lows),” BofA projects.

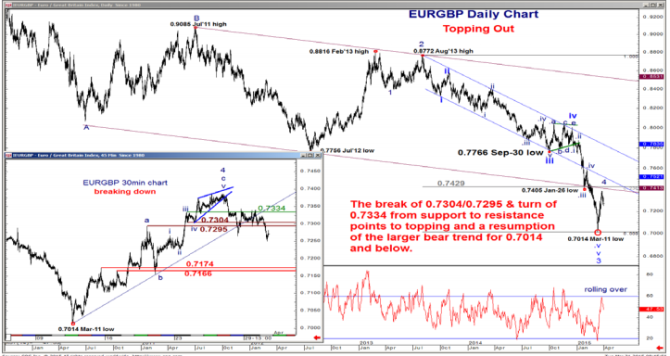

Meanwhile, BofA notes that the EUR continues to struggle, especially against GBP and the USD.

“Indeed, evidence says that EUR/GBP is topping out and resuming its long term downtrend following the break of multi-week pivot / support at 0.7304/0.7295 and the turn of old support into new resistance at 0.7334,” BofA clarifies.

“Through 0.7174/0.7166 confirms, targeting the Mar-11 lows at 0.7014 and below,” BofA projects.

However for EUR/USD, BofA thinks that message is still relatively mixed as the pair could still risk another squeeze higher.

“EUR/USD bears need a break of 1.0613 (the Mar-19 low) to confirm a resumption of the larger bear trend,” BofA argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.