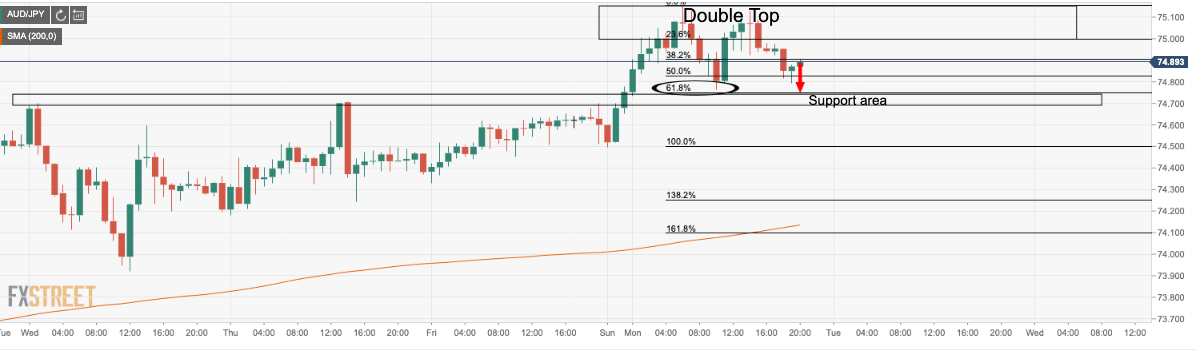

- AUD/JPY is trading below a double top, with a 61.8% retracement on the cards.

- RBA is next key risk event for AUD while markets continue to cheer recent positive economic data flows.

AUD/JPY is trading below a double top formed within the late June uptrend and at the top of the start of the week’s rally from 74.45 to 75.16.

Despite the concerns pertaining to COVID-19, the Asian financial markets kicked off on a positive foot with stock indices rallying.

This transpired to a bullish tone in European and US equities as well as forex.

Wall Street was accelerating gains with NASDAQ rallying 2% to a new all-time high and the S&P 500 closing 1.59% higher. Economic data continues to come in strong which is helping risk assets to recover across the board.

“Apart from the economic data, investors are encouraged that authorities will not impose widespread lockdowns again, preferring to manage outbreaks at a regional or local level, while still opting for relatively COVID-19 proof stocks,” analysts at ANZ Bank explained.

US ISM shows better-than-expected numbers from the service sector

Data released on Monday showed better-than-expected numbers from the service sector.

“‘Though the survey came before the recent jump in virus case counts, the non-manufacturing index signalled a sharp rebound in June`’, explained analysts at Wells Fargo.

“he activity index hit a 15-year high. Low base effects help and it is a tough road ahead.

The ISM non-manufacturing index rose to 57.1 in June—a much larger rise than had been expected—bringing the index close to where it was before the crisis. While the survey was conducted before the latest flare-up in case counts, the service sector was coming back online in a remarkable fashion.

There are signs that the worst of the impact from the virus and related lockdowns is fading. Supplier deliveries fell almost 10 points and orders picked up meaningfully to 61.6, even order backlogs moved into expansion territory.

RBA in focus

The RBA is expected to be keeping the cash rate on hold.

However, a resurgence of recent numbers in new coronavirus cases will be a concern. So too will the strength of the AUD which has travelled some 28% since its March bottoms vs the greenback down at 0.5506.

The Bank is likely to reiterate it stands ready to provide liquidity as needed. This was backed by actions last month, the Bank injecting short term funds to offset the sizeable maturity of reverse repos in June.

Expect significant liquidity over coming months as the Term Funding Facility is drawn down,

analysts at TD Securities explained.

-

AUD/USD Forecast: Waiting for RBA’s announcement

- Chart of The Week: AUD/USD traders enter the barroom brawl

AUD/JPY levels