- AUD/JPY bulls catch a breath after a three-day winning streak.

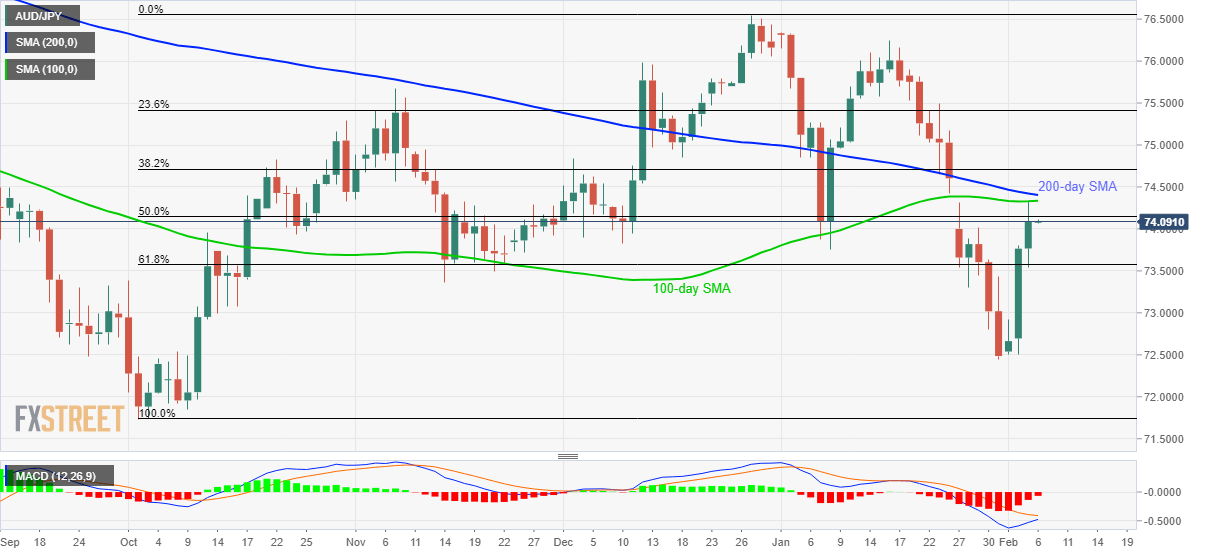

- 50% Fibonacci retracement adds to the nearby upside barriers, 61.8% Fibonacci retracement offers immediate support.

- Bearish MACD, nearness to the key resistances keep sellers hopeful.

AUD/JPY trades modestly changed while taking rounds to 74.10 amid the initial Asian session on Thursday. The pair surged to the nine-day top on Wednesday but failed to cross the key Moving Averages despite rising for the third consecutive day.

Not only failures to cross 100-day and 200-day SMAs, near 73.30 and 73.40 respectively, bearish MACD also increases the odds of the pair’s pullback after the recent run-up.

In doing so, 61.8% Fibonacci retracement of the pair’s October-December 2019 upside, at 73.58, will be the key to watch as a break of which will recall 73.00 and the latest lows near 72.50.

During the pair’s further declines below 72.50, October 2019 low near 71.70 will gain the bears’ attention.

Meanwhile, an upside clearance of 73.40 will escalate the pair’s recovery moves towards 75.00 mark whereas 23.6% Fibonacci retracement near 75.40 could please the bulls then after.

AUD/JPY daily chart

Trend: Pullback expected