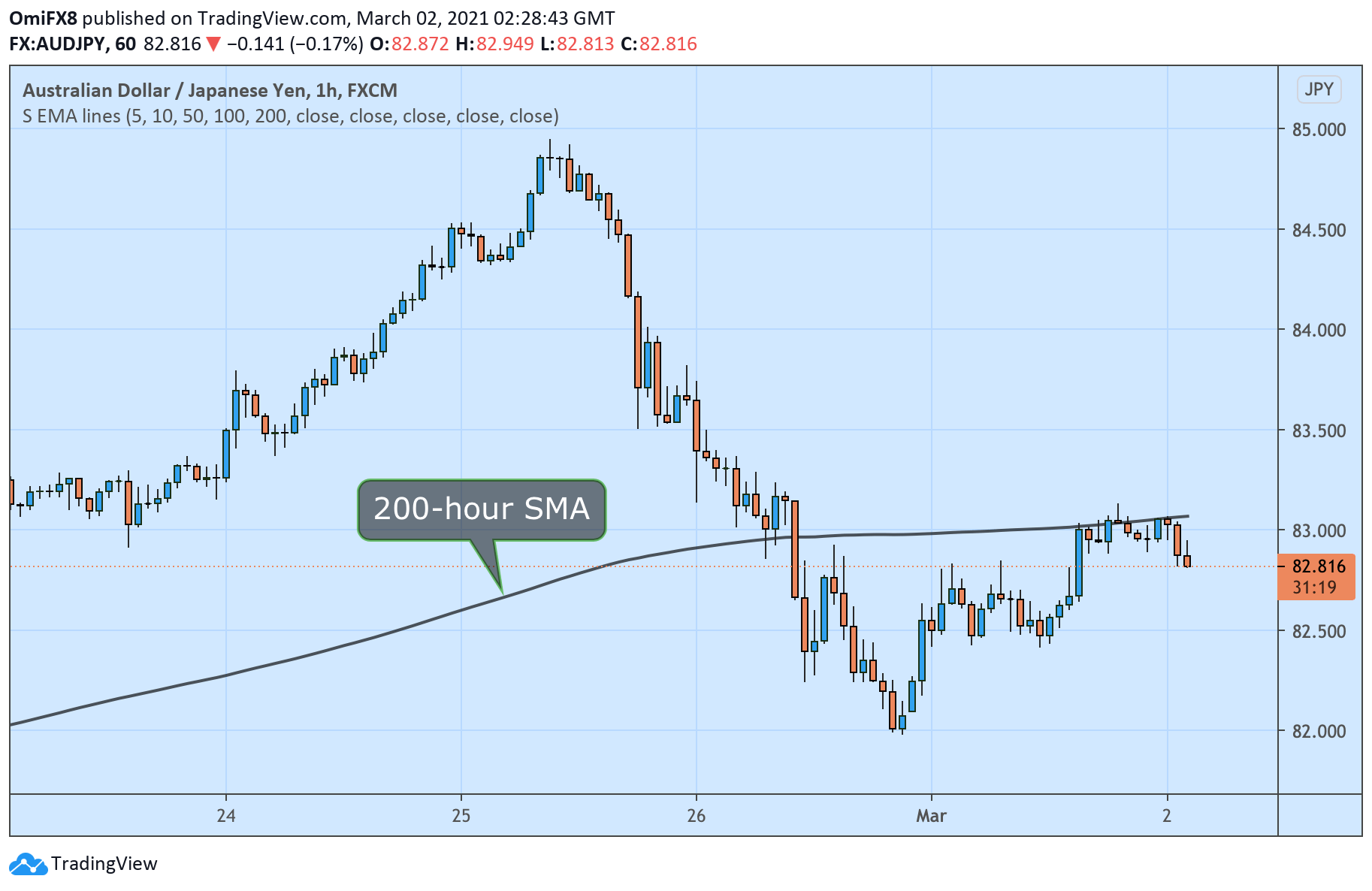

- AUD/JPY turns lower from the 200-hour SMA hurdle.

- RBA may resort to verbal intervention to stem AUD’s rise.

AUD/JPY’s bounce from Friday’s low of 81.98 is being capped by the 200-hour Simple Moving Average (SMA) hurdle of 83.07, with bulls refusing to lead the price action ahead of the Reserve Bank of Australia’s (RBA) rate decision due at 3:30 GMT.

While the RBA is unlikely to move interest rates, it could attempt jawboning the Aussie dollar, which recently rose to three-year highs against the dollar.

The central bank could also express concerns regarding the recent spike in domestic and global bond yields. The 10-year Australian yield rose roughly 80 basis points to 1.91% in February, tracking the US yields higher and putting downward pressure on stock markets last week.

AUD/JPY will likely chart a convincing move above the 200-hour SMA if the RBA downplays exchange rate concerns and assures the market of more effort to stem rising yields.

The central bank stepped up bond purchases on Monday, pushing the 10-year yield lower by more than 20 basis points and restoring the risk sentiment in stock markets.

Hourly chart

Trend: Bullish above 200-hour SMA

Technical levels