- AUD/JPY bears catch a breath following Friday’s heavy declines.

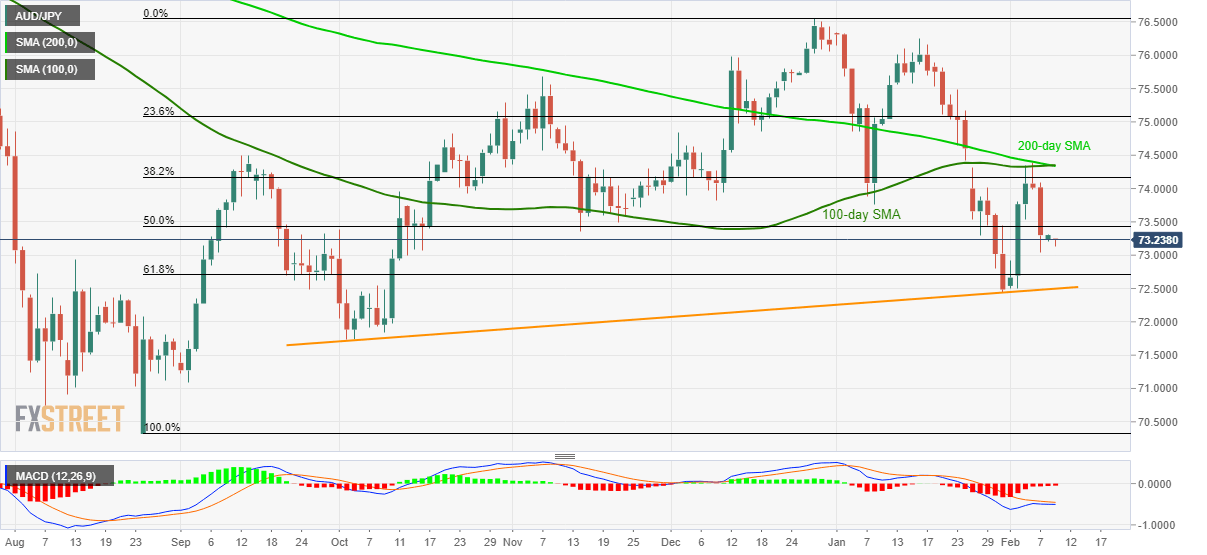

- 100 and 200-day SMA limit near-term upside, 61.8% Fibonacci retracement acts as the immediate support.

- An ascending trend line from early-October 2019 adds a barrier to the downside.

AUD/JPY remains modestly changed to 73.28 amid the Asian session on Monday. The pair failed to clear the key moving averages during its last week’s pullback moves while currently declining below 50% Fibonacci retracement of August-December 2019 upside.

With the MACD also flashing bearish signals AUD/JPY prices are likely to revisit a 61.8% Fibonacci retracement level of 72.70 during further declines.

However, an upward sloping trend line since October 02, 2019, at 72.50 now, will question the pair’s downside below 61.8% Fibonacci, if not then 72.00 and October 2019 low near 71.75 will gain the bears’ attention.

On the upside, 50% and 38.2% Fibonacci retracement levels, respectively, around 73.45 and 74.20, will restrict the pair’s immediate pullback ahead of the confluence of 100/200-day SMA near 74.30/35.

If at all the quote manages to cross 74.35 on a daily closing basis, it’s run-up to 75.0 can’t be ruled out.

AUD/JPY daily chart

Trend: Bearish